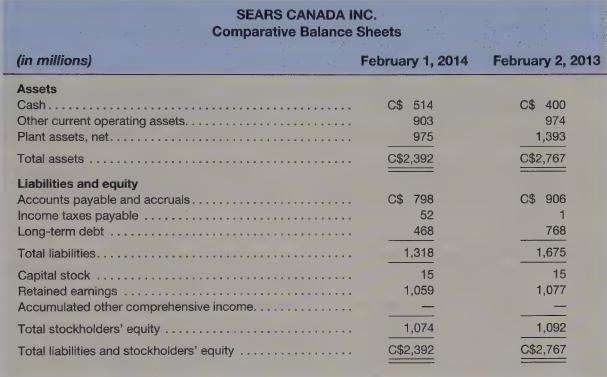

Comparative balance sheets and the intervening statement of income for Sears Canada Inc. appear below. Sears Canada

Question:

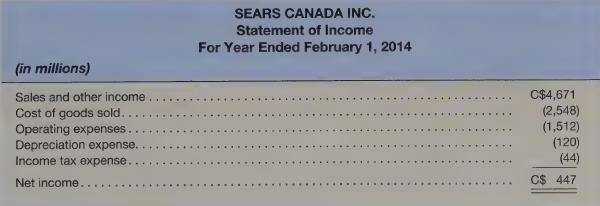

Comparative balance sheets and the intervening statement of income for Sears Canada Inc. appear below. Sears Canada is a subsidiary of Sears Holdings Corporation, a U.S. corporation. All amounts are in Canadian dollars.

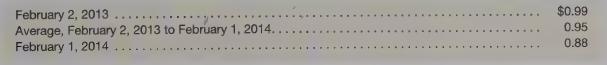

Sears Canada declared and paid dividends of \($465\) million during fiscal 2014. Exchange rates (U.S.\($/C$)\) are as follows:

Required

a. Prepare a statement of cash flows (indirect format) in Canadian dollars and U.S. dollars for the year ended February 1, 2014, and a computation of the effect of exchange rate changes on cash. Assume all investing and financing activities took place evenly throughout the year, other income includes gains of \($100\) million on dispositions of plant assets, and that Sears Canada’s functional currency is the Canadian dollar.

b. Prepare a schedule computing the February 1, 2014 cumulative translation adjustment balance (the only component of AOCTI), including computation of the translation adjustment for the year ended February 1, 2014. Assume that the beginning balance in AOCI was a gain of \($60.

c.\) How would the converted cash flow statement differ if Sears Canada’s functional currency was the US. dollar? Explain.

Step by Step Answer: