Dave, Brian, and Paul are partners in a retail appliance store. The partnership was formed January 1,

Question:

Dave, Brian, and Paul are partners in a retail appliance store. The partnership was formed January 1, 2019, with each partner investing $45,000. They agreed that profits and losses are to be shared as follows:

1. Divided in the ratio of 40:30:30 if net income is not sufficient to cover salaries, bonus, and interest.

2. A net loss is to be allocated equally.

3. Net income is to be allocated as follows if net income is in excess of salaries, bonus, and interest.

(a) Monthly salary allowances are:

Dave ........................... ? ?$3,500

Brian ........................... ? ? ?2,500

Paul ............................. ? ? 1,500

(b) Brian is to receive a bonus of 8% of net income before subtracting salaries and interest, but after subtracting the bonus.

(c) Interest of 10% is allocated based on the beginning-of-year capital balances.

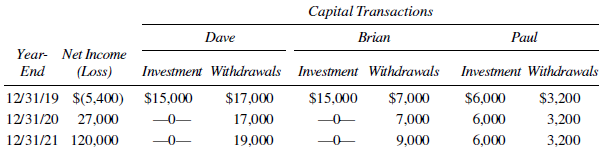

(d) Any remainder is to be allocated equally. Operating performance and other capital transactions were as follows.

Required:

A. Prepare a schedule of changes in partners? capital accounts for each of the three years.

B. Prepare the journal entry to close the income summary account to the partners? capital accounts at the end of each year.

PartnershipA legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer: