Following are separate income statements for Amarillo, Inc., and its 80 percentowned subsidiary, Saltillo Corporation as well

Question:

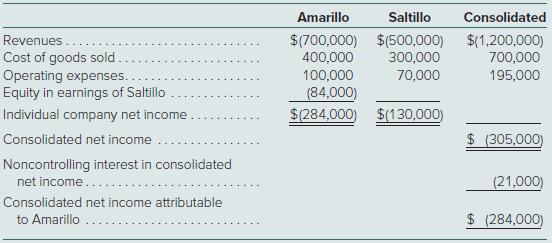

Following are separate income statements for Amarillo, Inc., and its 80 percent–owned subsidiary, Saltillo Corporation as well as a consolidated statement for the business combination as a whole (credit balances indicated by parentheses).

Additional Information∙ Annual excess fair over book value amortization of $25,000 resulted from the acquisition.∙ The parent applies the equity method to this investment.∙ Amarillo has 50,000 shares of common stock and 10,000 shares of preferred stock outstanding. Owners of the preferred stock are paid an annual dividend of $40,000, and each share can be exchanged for two shares of common stock.∙ Saltillo has 30,000 shares of common stock outstanding.∙ Saltillo has convertible bonds outstanding, none of which Amarillo owned. During the current year, total interest expense (net of taxes) was $22,000. These bonds can be exchanged for 10,000 shares of the subsidiary’s common stock.

Determine Amarillo’s basic and diluted EPS.

Step by Step Answer:

Fundamentals Of Advanced Accounting

ISBN: 9781266268533

9th International Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik