For this problem, refer to the information provided in Problem 13-3 for P Company and SFr Company.

Question:

For this problem, refer to the information provided in Problem 13-3 for P Company and SFr Company. Ignore deferred income taxes in the assignment of the difference between implied and book value.

Required:

A. If you have not already done so, prepare a workpaper to translate the trial balance of the subsidiary into dollars using the current rate method.

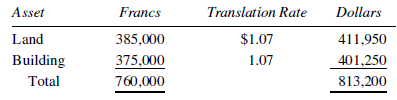

B. Prepare the journal entries made on the books of P Company during 2020 to account for its investment in SFr Company. P Company uses the cost method to record its investment in SFr Company. At the date of acquisition, the 760,000 franc difference between implied and book value interest acquired was allocated as follows:

The building is depreciated over a 10-year remaining life using the straight-line method of amortization.

C. Prepare a consolidated statement?s workpaper at December 31, 2020.

Data from 13-3

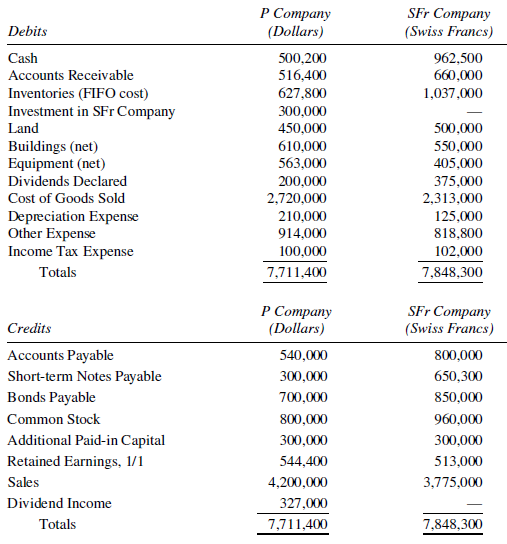

On January 2, 2019, P Company, a U.S.-based company, acquired for 2,000,000 francs an 80% interest in SFr Company, a Swiss company. On January 2, 2019, SFr Company reported a retained earnings balance of 480,000 francs. SFr?s books are maintained in Swiss francs and are in conformity with U.S. generally accepted accounting principles. Trial balances of the two companies as of December 31, 2020, are presented here:

Other information related to the subsidiary follows:1. Beginning inventory of 830,000 Swiss francs was acquired when the exchange rate was $1.078.2. Purchases made uniformly throughout 2020 were 2,520,000 francs.3. The Swiss franc is identified as the subsidiary?s functional currency.4. The subsidiary?s beginning (1/1/20) retained earnings and cumulative translation adjustment (credit) in dollars were $175,948 and $390,691 respectively.5. All plant assets were acquired before the parent obtained a controlling interest in the subsidiary.6. Sales are made and all expenses are incurred uniformly throughout the year.7. The ending inventory was acquired during the last quarter.8. The subsidiary declared and paid dividends of 375,000 francs on September 2.9. The following direct exchange rate quotations were available:Date of subsidiary acquisition ............................ ?$1.07Average for 2014 .................................................. ? ?1.075January 1, 2015 ..................................................... ? ?1.08September 2, 2015 ............................................... ? ?1.09December 31, 2015 .............................................. ? ?1.10Average for the 4th quarter, 2015 ..................... ? ?1.095Average for 2015 ................................................. ? ? 1.085

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Exchange Rate

The value of one currency for the purpose of conversion to another. Exchange Rate means on any day, for purposes of determining the Dollar Equivalent of any currency other than Dollars, the rate at which such currency may be exchanged into Dollars...

Step by Step Answer: