Hunnington Township?s adjusted trial balance for the General Fund at the close of its fiscal year ended

Question:

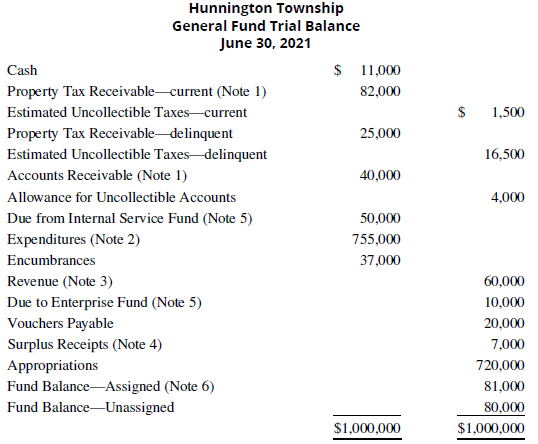

Hunnington Township?s adjusted trial balance for the General Fund at the close of its fiscal year ended June 30, 2021, is presented here:

Note 1: The current tax roll and accounts receivable, recorded on the accrual basis as sources of revenue, amounted to $500,000 and $200,000, respectively.

Note 2: Includes $42,500 paid during the fiscal year in settlement of all purchase orders outstanding at the beginning of the fiscal year.

Note 3: Represents the difference between the budgeted (estimated) revenue of $700,000 and the actual revenue realized during the fiscal year.

Note 4: Represents the proceeds from the sale of equipment damaged by fire. The equipment originally cost $40,000 and had been held for 80% of its useful life prior to the fire.

Note 5: The interfund payable and receivable resulted from cash advances (loans) to and from the respective funds.

Note 6: Includes $44,000 of encumbrances from prior year.

Required:

A. Prepare a statement of revenues, expenditures, and changes in fund balance.

B. Prepare a balance sheet for the General Fund at June 30, 2021.?

(AICPA adapted)

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer: