In accordance with U.S. GAAP, which translation combination is appropriate for a foreign operation whose functional currency

Question:

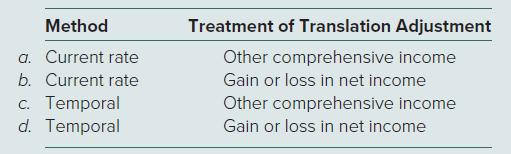

In accordance with U.S. GAAP, which translation combination is appropriate for a foreign operation whose functional currency is the U.S. dollar?

Transcribed Image Text:

Method a. Current rate b. Current rate c. Temporal Temporal d. Treatment of Translation Adjustment Other comprehensive income Gain or loss in net income Other comprehensive income Gain or loss in net income

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (6 reviews)

d When the US dollar is the func...View the full answer

Answered By

Shubhradeep Maity

I am an experienced and talented freelance writer passionate about creating high-quality content. I have over five years of experience working in the field and have collaborated with several renowned companies and clients in the SaaS industry.

At Herman LLC, an online collective of writers, I generated 1,000+ views on my content and created journal content for 100+ clients on finance topics. My efforts led to a 60% increase in customer engagement for finance clients through revamping website pages and email interaction.

Previously, at Gerhold, a data management platform using blockchain, I wrote and published over 50 articles on topics such as Business Finance, Scalability, and Financial Security. I managed four writing projects concurrently and increased the average salary per page from $4 to $7 in three months.

In my previous role at Bernier, I created content for 40+ clients within the finance industry, increasing sales by up to 40%.

I am an accomplished writer with a track record of delivering high-quality content on time and within budget. I am dedicated to helping my clients achieve their goals and providing exceptional results.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Advanced Accounting

ISBN: 9781264798483

15th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer And Timothy Doupnik

Question Posted:

Students also viewed these Business questions

-

In accordance with U.S. generally accepted accounting principles, which translation combination is appropriate for a foreign operation whose functional currency is the U.S. dollar? ....Method...

-

Multiple Choice Questions 1. Assume that the U.S. dollar is the subsidiarys functional currency. What balances does a consolidated balance sheet report as of December 31, 2011? a. Marketable equity...

-

Multiple Choice Questions Which of the following items is normally translated the same way under both the current rate and temporal methods of translation? a. Inventory b. Equipment c. Sales revenue...

-

How important it is to educate ourselves environmental issues impacting the future of tourism i.e., climate change The COVID-19 pandemic has changed the tourism industry forever and will impact our...

-

The information on earnings and deductions for the pay period ended December 14 from King Companys payroll records is as follows: For each employee, the Social Security tax is 4.2 percent of the...

-

Your son has been accepted into college. This college guarantees that your sons tuition will not increase for the four years he attends college. The first $10,000 tuition payment is due in six...

-

Describe the nature of business strategy. LO.1

-

Jack asked Jill to marry him, and she has accepted under one condition: Jack must buy her a new $330,000 Rolls-Royce Phantom. Jack currently has $45,530 that he may invest. He has found a mutual fund...

-

On June 30, 2021, Blue, Inc. leased a machine from Big Leasing Corporation. The lease agreement qualifies as a capital lease and calls for Blue to make semiannual lease payments of $183,294 over a...

-

On January 1, Narnevik Corporation formed a subsidiary in a foreign country. On April 1, the subsidiary purchased inventory on account at a cost of 250,000 local currency units (LCU). One-fifth of...

-

A U.S. companys foreign subsidiary had these amounts in local currency units (LCU) in 2024: The average exchange rate during 2024 was $1.00 = LCU 1. The beginning inventory was acquired when the...

-

Use numerical integration to estimate the value of = 4 0 1 1 + x dx.

-

Sample for a Poll There are 30,488,983 Californians aged 18 or older. If The Gallup organization randomly selects 1068 adults without replacement, are the selections independent or dependent? If the...

-

Part A: You have successfully graduated Conestoga College and have joined a public accounting firm in their tax department. You have been assigned to work on a project with Emily Wilson, one of the...

-

Write a program that gets a list of integers from input, and outputs negative integers in descending order (highest to lowest). Ex: If the input is: 10 -7 4-39 -6 12 -2 the output is: -2-6-7-39 For...

-

The manager of a division that produces add-on products for the automobile industry had just been presented the opportunity to invest in two independent projects. The first is an air conditioner for...

-

4. We are interested in the effect on test scores of the student-teacher ratio (STR). The following regression results have been obtained using the California data set. All the regressions used...

-

Deer Lake Inc. uses a job order costing system with manufacturing overhead applied to products at a rate of 150% of direct labor cost. Find the missing amounts by treating each case independently....

-

Interview managers at three companies in your area about their use of ERP. How have their experiences been similar? What accounts for the similarities and differences?

-

Consolidation workpaper entries are made to eliminate 100 percent of the unrealized profit from the land account in downstream sales of land. Is 100 percent also eliminated for upstream sales of land?

-

How are unrealized gains and losses from intercompany transactions involving depreciable assets eventually realized?

-

How are unrealized gains and losses from intercompany transactions involving depreciable assets eventually realized?

-

Jennifer purchased a home for $1,000,000 in 2016. She paid $200,000 cash and borrowed the remaining $800,000. This is Jennifer's only residence. Assume that in year 2024, when the home had...

-

business plan describing company with strengths and weaknesses. Any gaps in plan. Recommendations for improvement of the plan.

-

You wish to buy a car today for $35,000. You plan to put 10% down and finance the rest at 5.20% p.a. for six years. You will make equal monthly payments of $_______.

Study smarter with the SolutionInn App