Lynch, Inc., is a hardware store operating in Boulder, Colorado. Management recently made several poor inventory acquisitions

Question:

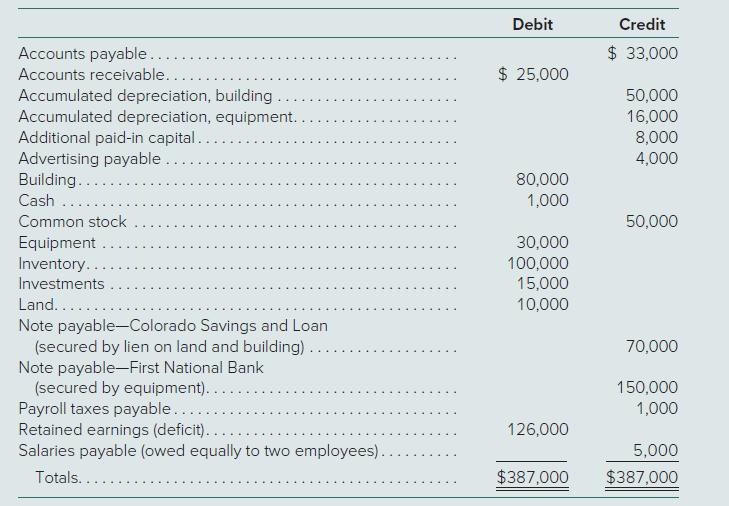

Lynch, Inc., is a hardware store operating in Boulder, Colorado. Management recently made several poor inventory acquisitions that have loaded the store with unsalable merchandise. Because of the drop in revenues, the company is now insolvent. The entire inventory can be sold for only $33,000. The following is a trial balance as of March 14, 2024, the day the company files for a Chapter 7 liquidation:

Company officials believe that 60 percent of the accounts receivable can be collected if the company is liquidated. The building and land have an estimated liquidation value of $75,000. The equipment is worth $19,000. The investments represent shares of a nationally traded company that can be sold at the current time for $21,000. Administrative expenses necessary to carry out a liquidation would approximate $16,000.

Prepare a statement of financial affairs for Lynch, Inc., as of March 14, 2024.

∙ The investments are sold for $21,000.

∙ Administrative expenses total $20,000 as of July 23, 2024, but no payment has been made yet.

a. Prepare a statement of realization and liquidation for the period from March 14, 2024, through July 23, 2024.

b. How much cash would be paid to an unsecured, nonpriority creditor that Lynch, Inc., owes a total of $1,000?

Step by Step Answer:

Advanced Accounting

ISBN: 9781264798483

15th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer And Timothy Doupnik