Now assume PR paid ($8,000) in cash for SXs net assets. There are no consultant fees, and

Question:

Now assume PR paid \($8,000\) in cash for SX’s net assets. There are no consultant fees, and no shares are issued. Assume that SX’s previously unrecorded intangible assets, capitalizable per GAAP, have a fair value of \($500\). PR records a bargain gain of

a. \($0\)

b. \($3,100\)

c. \($3,600\)

d. \($4,100\)

PR Company pays \($10,000\) in cash and issues no-par stock with a fair value of \($40,000\) to acquire all of SX Corporation’s net assets. SX’s balance sheet at the date of acquisition is as follows:

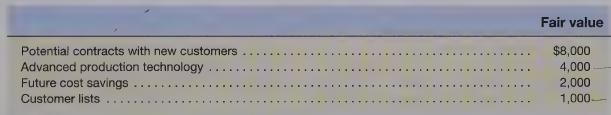

PR’s consultants find these items that are not reported on SX’s balance sheet:

Outside consultants are paid \($200\) in cash, and registration fees to issue PR’s new stock are \($400.\)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: