On December 10, 2017, Robin Franchises, a U.S. company, received a purchase order from a U.K. customer

Question:

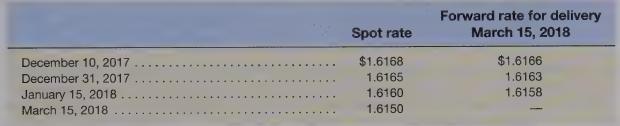

On December 10, 2017, Robin Franchises, a U.S. company, received a purchase order from a U.K. customer for delivery of merchandise on January 15, 2018. The price of the merchandise is 8,000,000, payable on March 15, 2018, in pounds. To hedge its exposure to exchange rate changes, on December 10, 2017, Robin entered a forward contract for delivery of 8,000,000 to the broker on March 15, 2018. The merchandise was delivered as scheduled. On March 15, 2018, Robin received payment from the customer, and delivered the pounds to the broker to close the forward contract. Robin's accounting year ends December 31. Exchange rates (\($/)\) are as follows:

Required

Prepare the journal entries Robin Franchises made on January 15, 2018 and March 15, 2018 to record the above transactions, as well as its end-of-year adjusting entries on December 31, 2017.

Step by Step Answer: