On December 18, 2024, Stephkado Corporation acquired 100 percent of a Swiss company for 4.0 million Swiss

Question:

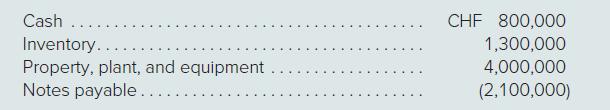

On December 18, 2024, Stephkado Corporation acquired 100 percent of a Swiss company for 4.0 million Swiss francs (CHF), which is indicative of book and fair value. At the acquisition date, the exchange rate was $1.00 = CHF 1. On December 18, 2024, the book and fair values of the subsidiary’s assets and liabilities were as follows:

Stephkado prepares consolidated financial statements on December 31, 2024. By that date, the Swiss franc has appreciated to $1.10 = CHF 1. Because of the year-end holidays, no transactions took place prior to consolidation. Property, plant, and equipment is depreciated using a units-ofproduction method, so no depreciation is required from December 18 to December 31. The Swiss subsidiary has no revenues and no expenses from December 18 to December 31, and its book value is unchanged from December 18 to December 31.

a. Determine the translation adjustment to be reported on Stephkado’s December 31, 2024, consolidated balance sheet, assuming that the Swiss franc is the Swiss subsidiary’s functional currency. What is the economic relevance of this translation adjustment?

b. Determine the remeasurement gain or loss to be reported in Stephkado’s 2024 consolidated net income, assuming that the U.S. dollar is the functional currency. What is the economic relevance of this remeasurement gain or loss?

Step by Step Answer:

Advanced Accounting

ISBN: 9781264798483

15th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer And Timothy Doupnik