On January 1, 2016, Pine Mountain Resorts acquires a 60 percent interest in Shawnee Peak Enterprises for

Question:

On January 1, 2016, Pine Mountain Resorts acquires a 60 percent interest in Shawnee Peak Enterprises for \($25.4\) million in cash. The date-of-acquisition fair value of the noncontrolling interest in Shawnee is estimated at \($11.6\) million. Shawnee’s book value at the date of acquisition is \($2\) million. Its reported assets and liabilities are carried at amounts approximating fair value, except property and equipment, with a remaining life of 10 years, straight-line, is overvalued by \($5\) million. Previously unrecorded licenses and certificates, with a remaining life of four years, straight-line, are valued at \($8\) million. Goodwill from this acquisition is impaired by \($150,000\) in 2016.

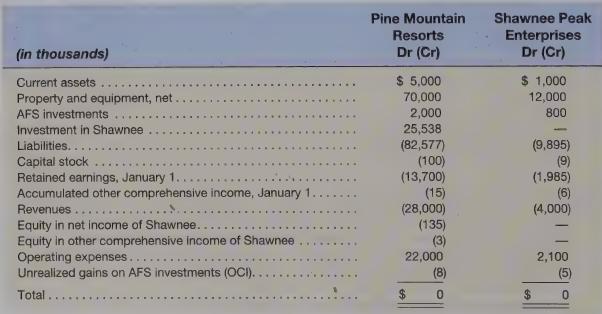

The December 31, 2016, trial balances of Pine Mountain and Shawnee are below. Pine Mountain uses the complete equity method to report the investment on its own books.

For all answers, show amounts in thousands and use U.S. GAAP.

Required

a. Calculate the total goodwill for this acquisition and its allocation to the controlling and noncontrolling interest.

b. Calculate 2016 equity in net income of Shawnee, appearing on Pine Mountain’s books, and 2016 noncontrolling interest in net income of Shawnee, appearing on the 2016 consolidated income statement.

c. Prepare a working paper to consolidate the trial balances of Pine Mountain and Shawnee at December 31, 2016.

d. Prepare a consolidated statement of income and comprehensive income for 2016, and a consolidated balance sheet at December 31, 2016, in good form.

Step by Step Answer: