On January 1, 2016, the U.K. subsidiary of U.S. International Corporation had the following condensed balance sheet,

Question:

On January 1, 2016, the U.K. subsidiary of U.S. International Corporation had the following condensed balance sheet, in pounds sterling (in millions):

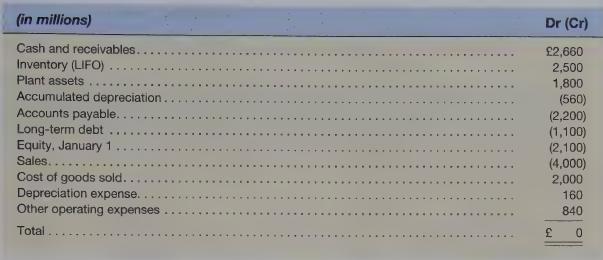

The exchange rate on January 1, 2016 was \($2/£.\) Inventory and plant assets at January 1 were acquired when the exchange rate was \($1.80/£.\) Plant assets costing £200 million were purchased when the exchange rate was \($2.15/£.\) No depreciation was taken on these assets in 2016, and no transactions between the parent and the subsidiary occurred during 2016. At the end of 2016, the subsidiary reported the following trial balance:

The exchange rate when the new LIFO layer arose was \($2.05/£\) and the subsidiary purchased merchandise sold at an average exchange rate of \($2.12/£.\) Sales and other operating expenses occurred evenly over the year. At year-end, the exchange rate was \($2.20/£;\) the average for the year was \($2.10/£.\)

Required

a. Prepare the remeasured December 31, 2016 trial balance of the U.K. subsidiary, assuming the dollar is the functional currency of the subsidiary. Assume the remeasured balance of equity on January 1, 2016 was \($3,520\) million. Prepare a schedule to calculate the remeasurement gain or loss for 2016.

b. Repeat part a, assuming the pound is the functional currency of the subsidiary. Assume the translated balance of equity on January 1, 2016, is \($4,200\) million. Prepare a schedule to calculate the translation gain or loss for 2016.

Step by Step Answer: