On January 1, 2018, Phelps Company purchased an 85% interest in Sloane Company for $955,000 when the

Question:

On January 1, 2018, Phelps Company purchased an 85% interest in Sloane Company for $955,000 when the retained earnings of Sloane Company were $150,000. The difference between implied and book value was assigned as follows:

Inventory....................................................$48,000Land..............................................................36,000Discount on Bonds Payable.......................48,000Goodwill.......................................................91,529

One-half of the inventory was sold in 2018 and the remaining inventory was sold in 2019. The bonds mature in eight years.

On December 31, 2018, Phelps Company?s inventory contained $10,000 in unrealized intercompany profit. During 2019 Phelps Company sold merchandise with a cost of $200,000 to Sloane Company at a 30% markup on cost. Only $65,000 (selling price) of this merchandise remains in Sloane Company?s 2019 ending inventory. As of December 31, 2019, Sloane Company owes Phelps Company $40,000 for merchandise purchased during 2019.

Equipment with a book value of $500,000 was sold by Sloane Company on January 2, 2019, to Phelps Company for $640,000. This equipment had an estimated useful life when purchased by Sloane Company on July 1, 2016, of 10 years.

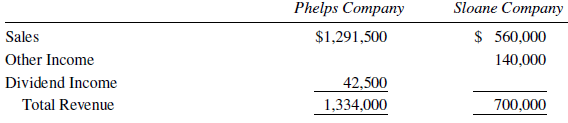

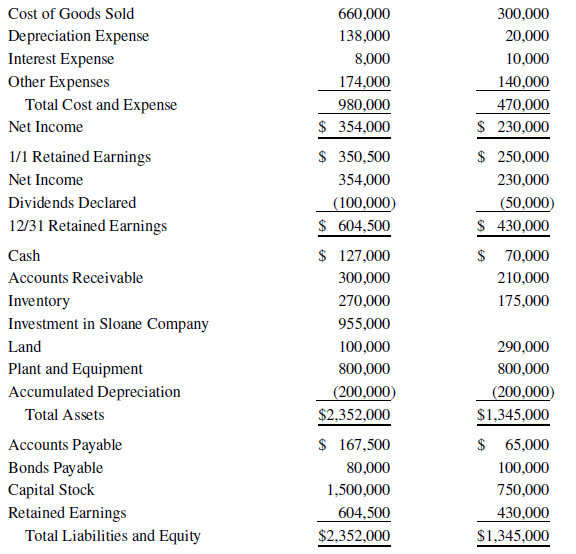

Financial data for 2019 are presented here:

Required:

Prepare a consolidated financial statements workpaper for the year ended December 31, 2019.

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer: