On January 3, 2016, Allen Corporation and Barkely Corporation invested ($5) million each in cash to form

Question:

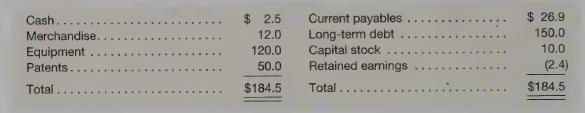

On January 3, 2016, Allen Corporation and Barkely Corporation invested \($5\) million each in cash to form Albar Enterprises, a joint venture that develops new products benefitting both corporations. Each corporation holds an equal ownership interest in Albar Enterprises. Albar Enterprises' balance sheet on December 31, 2016, follows (in millions):

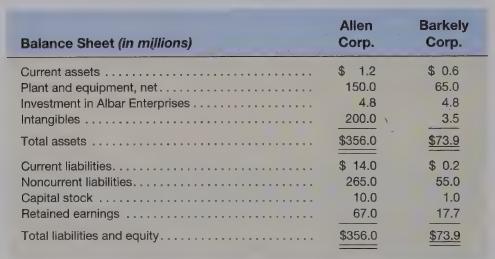

The joint venture distributed \($0.2\) million in cash to each of its investors at the end of 2016. December 31, 2016, balance sheets for each corporation are below. Each shows its investment in Albar Enterprises at original cost less the cash distribution.

Both corporations use the equity method to report their investment in Albar Enterprises. Barkely estimates that the fair value of its investment in Albar declined to \($0.5\) million as of December 31, 2016, and that the decline is other-than-temporary. Allen does not report a decline in the value of its investment.

Required

a. Prepare the adjusting entry or entries Allen and Barkely' make at the end of 2016.

b. Present the December 31, 2016, balance sheets of each corporation, after appropriate adjustments for their joint venture investment.

c. Is it appropriate for Barkely to report an impairment loss on its investment in the joint venture, while Allen does not? Explain.

Step by Step Answer: