On July 1, 2016, Prestige Communications acquired all of the voting stock of Southern Light Technologies for

Question:

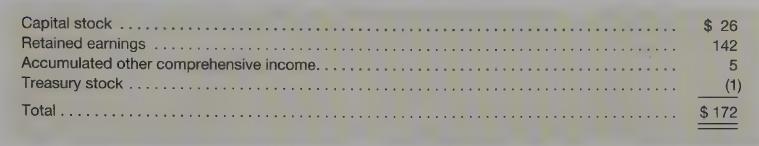

On July 1, 2016, Prestige Communications acquired all of the voting stock of Southern Light Technologies for \($300\) million in cash. At the date of acquisition, Southern Light's stockholders' equity accounts were as follows (in millions):

At the date of acquisition, Southern Light’s inventories and property, plant and equipment had a fair value that was \($2\) million and \($10\) million lower than book value, respectively. It also had previously unreported brand names, valued at \($60\) million, meeting the ASC 805 criteria for separate capitalization. Southern Light reports inventories using FIFO, its revalued plant and equipment had a 10-year remaining life, straight-line, and the brand names are indefinite lived. Both companies have June 30 year-ends.

Southern Light reported \($20\) million in net income and \($500,000\) in other comprehensive income in fiscal 2017, and declared and paid \($2.5\) million in cash dividends. Impairment testing at the end of fiscal 2017 reveals that Southern Light’s brand names are impaired by \($3\) million and goodwill connected with the acquisition is impaired by \($5\) million in 2017.

In your answers below, show all numbers in thousands.

Required

a. Calculate equity in net income of Southern Light, appearing on Prestige Communication’s books, for fiscal 2017. Prestige uses the complete equity method to account for its investment.

b. Prepare Prestige Communications’ journal entries during 2017 to report its investment in Southern Light, on its own books.

c. Prepare the consolidation eliminating entries (C), (E), (R) and (O), required to consolidate Prestige Communications’ accounts with those of Southern Light Technologies at June 30, 2017.

Step by Step Answer: