On June 30, 2020, Wisconsin, Inc., issued $300,000 in debt and 15,000 new shares of its $10

Question:

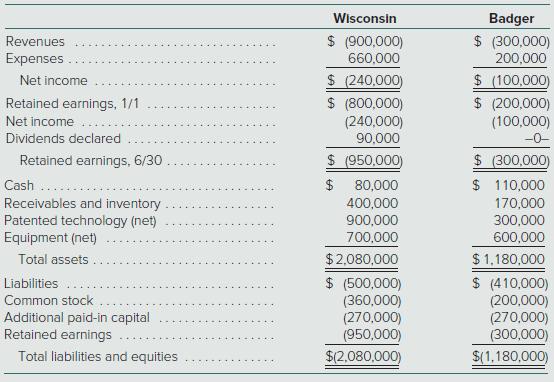

On June 30, 2020, Wisconsin, Inc., issued $300,000 in debt and 15,000 new shares of its $10 par value stock to Badger Company owners in exchange for all of the outstanding shares of that company. Wisconsin shares had a fair value of $40 per share. Prior to the combination, the financial statements for Wisconsin and Badger for the six-month period ending June 30, 2020, were as follows (credit balances in parentheses):

Wisconsin also paid $30,000 to a broker for arranging the transaction. In addition, Wisconsin paid $40,000 in stock issuance costs. Badger’s equipment was actually worth $700,000, but its patented technology was valued at only $280,000.

What are the consolidated balances for the following accounts?

a. Net income

b. Retained earnings, 1/1/20

c. Patented technology

d. Goodwill

e. Liabilities

f. Common stock

g. Additional paid-in capital

Wisconsin $ (900,000) 660,000 Badger $ (300,000) 200,000 Revenues Expenses $ (240,000) $ (800,000) (240,000) 90,000 $ (100,000) $ (200,000) (100,000) Net income Retained earnings, 1/1 Net income Dividends declared -0- $ (300,000) $ 110,000 170,000 Retained earnings, 6/30 $ (950,000) Cash Receivables and inventory Patented technology (net) Equipment (net) $ 80,000 400,000 900,000 300,000 700,000 600,000 $2,080,000 $ (500,000) (360,000) (270,000) (950,000) $(2,080,000) $ 1,180,000 $ (410,000) (200,000) (270,000) (300,000) Total assets . Liabilities Common stock Additional paid-in capital Retained earnings Total liabilities and equities $(1,180,000)

Step by Step Answer:

Under the acquisition method the shares issued by Wisconsin are recorded at fair value using the fol...View the full answer

Advanced Accounting

ISBN: 9781260247824

14th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik

Students also viewed these Business questions

-

On June 30, 2011, Wisconsin, Inc., issued $300,000 in debt and 15,000 new shares of its $10 par value stock to Badger Company owners in exchange for all of the outstanding shares of that company....

-

On June 30, 2015, Wisconsin, Inc., issued $300,000 in debt and 15,000 new shares of its $10 par value stock to Badger Company owners in exchange for all of the outstanding shares of that company....

-

On June 30, 2013, Wisconsin, Inc., issued $300,000 in debt and 15,000 new shares of its $10 par value stock to Badger Company owners in exchange for all of the outstanding shares of that company....

-

In a recent survey, 80% of the community favored building a police substation in their neighborhood. If 20 citizens are chosen, what is the mean and standard deviation for the number favoring the...

-

Predict the molecular geometry of each of the following molecules: (a). (b). (c). H-N- N-H

-

Which of the following measures indicates the abil ity of a firm to pay its current liabilities? A. Working capital C. Quick ratio B. Current ratio D. All of the above AppendixLO1

-

Given the following costs, which process should be used for an order of 400 pieces of a given part? What will be the unit cost for the process selected? Buy Process A Process B Setup $40.00 $180.00...

-

Addison Manufacturing holds a large portfolio of debt and equity investments. The fair value of the portfolio is greater than its original cost, even though some investments have decreased in value....

-

You have a single liability of 14,000 payable at time 6. You attempt to fully immunize this liability by buying two zero coupon bonds with maturities at times 2 and 12. The yield curve is a flat 4%....

-

Since East Coast Yachts is producing at full capacity, Larissa has decided to have Dan examine the feasibility of a new manufacturing plant. This expansion would represent a major capital outlay for...

-

In the December 31, 2020, consolidated balance sheet of Patrick and its subsidiary, what amount of total stockholders equity should be reported? a. $1,100,000 b. $1,125,000 c. $1,150,000 d....

-

On January 1, 2021, Casey Corporation exchanged $3,300,000 cash for 100 percent of the outstanding voting stock of Kennedy Corporation. Casey plans to maintain Kennedy as a wholly owned subsidiary...

-

Two objects have the same kinetic energy. Do they necessarily have the same momentum? Explain.

-

The following information summarizes the activities in the Mixing Department for the month of March. Beginning inventory 1 , 0 0 0 units, 8 0 % complete Started and completed 2 4 , 5 0 0 units Ending...

-

What is your recommendation for the maximum size of coarse aggregate for the following situation? A continuously reinforced concrete pavement cross section contains a layer of No. 6 reinforced bars...

-

On January 1, 2024, Winn Heat Transfer leased office space under a three-year operating lease agreement. The arrangement specified three annual lease payments of $72,000 each, beginning December 31,...

-

A closed square pyramid tank (base width: 6.0 m; height 3.0 m), sitting on its square base, has a 1.0 m depth of water. Suppose this tank is inverted (turned upside down) and is made to stand on its...

-

P.4.3 Apply a Taylor series expansion to a mixed backward formula for the first derivative: (Ux)i = 1 Ax (aui-2+ bui-1 + cu + dui+1) Derive the family of second order accurate formulas and the...

-

Fill in the blank with an appropriate word, phrase, or symbol(s). The voting method that may involve a series of elections until a candidate receives a majority of the votes is called the _______...

-

Identify the tax issues or problems suggested by the following situations. State each issue as a question. Jennifer did not file a tax return for 2007 because she honestly believed that no tax was...

-

Several years ago Brant, Inc., sold $900,000 in bonds to the public. Annual cash interest of 9 percent ($81,000) was to be paid on this debt. The bonds were issued at a discount to yield 12 percent....

-

Garfun, Inc., owns all of the stock of Simon, Inc. For 2014, Garfun reports income (exclusive of any investment income) of $480,000. Garfun has 80,000 shares of common stock outstanding. It also has...

-

The following separate income statements are for Burks Company and its 80 percentowned subsidiary, Foreman Company: Additional Information Amortization expense resulting from Foremans excess...

-

please help Problem 13-7 (Algo) Prepare a Statement of Cash Flows [LO13-1, LO13-2] [The following information applies to the questions displayed below.] Comparative financial statements for Weaver...

-

A firm has 1000 shareholders, each of whom own $59 in shares. The firm uses $28000 to repurchase shares. What percentage of the firm did each of the remaining shareholders own before the repurchase,...

-

Vancouver Bank agrees to lend $ 180,000 to Surrey Corp. on November 1, 2020 and the company signs a six-month, 6% note maturing on May 1, 2021. Surrey Corp. follows IFRS and has a December 31 fiscal...

Study smarter with the SolutionInn App