On June 30, 2024, Plaster, Inc., paid $916,000 for 80 percent of Stucco Companys outstanding stock. Plaster

Question:

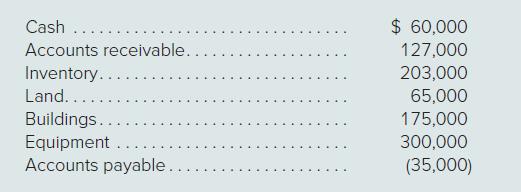

On June 30, 2024, Plaster, Inc., paid $916,000 for 80 percent of Stucco Company’s outstanding stock. Plaster assessed the acquisition-date fair value of the 20 percent noncontrolling interest at $229,000. At acquisition date, Stucco reported the following book values for its assets and liabilities:

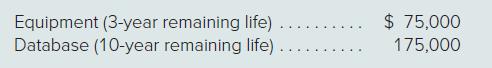

On June 30, Plaster allocated the excess acquisition-date fair value over book value to Stucco’s assets as follows: At the end of 2024, the following comparative (2023 and 2024) balance sheets and consolidated income statement were available:

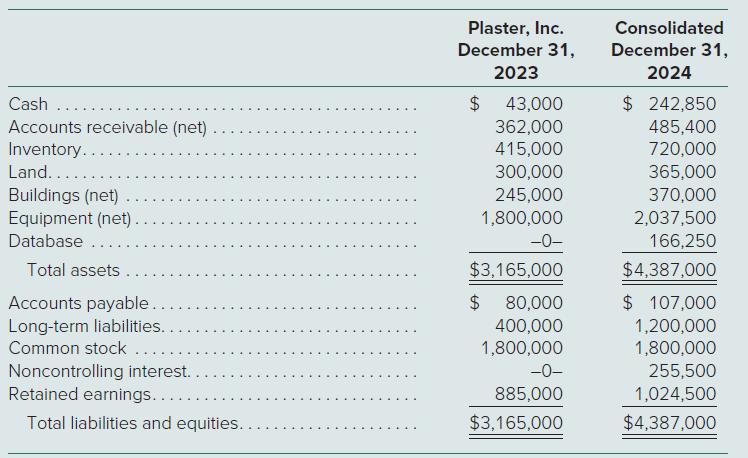

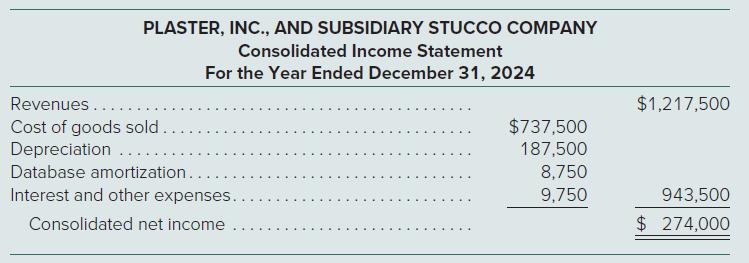

At the end of 2024, the following comparative (2023 and 2024) balance sheets and consolidated income statement were available:

Additional Information for 2024

∙ On December 1, Stucco paid a $40,000 dividend. During the year, Plaster paid $100,000 in dividends.

∙ During the year, Plaster issued $800,000 in long-term debt at par.

∙ Plaster reported no asset purchases or dispositions other than the acquisition of Stucco.

Prepare a 2024 consolidated statement of cash flows for Plaster and Stucco. Use the indirect method of reporting cash flows from operating activities.

Step by Step Answer:

Advanced Accounting

ISBN: 9781264798483

15th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer And Timothy Doupnik