On November 1, 2023, Good Life Company forecasts the purchase of raw materials from a Chilean supplier

Question:

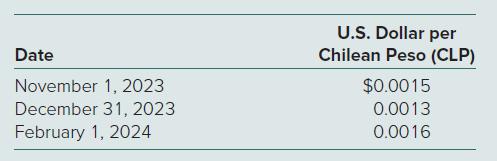

On November 1, 2023, Good Life Company forecasts the purchase of raw materials from a Chilean supplier on February 1, 2024, at a price of 20,000,000 Chilean pesos. On November 1, 2023, Good Life pays $1,500 for a three-month call option on 20,000,000 pesos with a strike price of $0.0015 per peso. On December 31, 2023, the option has a fair value of $1,100. The following spot exchange rates apply:

Good Life properly designates the option as a cash flow hedge of a forecasted foreign currency transaction. The time value of the option is excluded from the assessment of hedge effectiveness, and the change in time value is recognized in net income over the life of the option. Raw materials are received and paid for on February 1, 2024, and the finished goods into which the materials are incorporated are sold by March 30, 2024.

Prepare all journal entries for Good Life Company related to this transaction and hedge, and answer the following questions:

a. What is the net impact on Good Life Company’s 2023 net income as a result of this hedge of a forecasted foreign currency transaction?

b. What is the net impact on Good Life Company’s 2024 net income as a result of this hedge of a forecasted foreign currency transaction and import purchase? Assume that the raw materials are consumed and become a part of the cost of goods sold in 2024.

Step by Step Answer:

Advanced Accounting

ISBN: 9781264798483

15th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer And Timothy Doupnik