On September 1, 2023, Stone Company received an order to sell a machine to a customer in

Question:

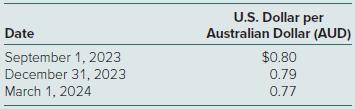

On September 1, 2023, Stone Company received an order to sell a machine to a customer in Australia at a price of 100,000 Australian dollars. Stone shipped the machine and received payment on March 1, 2024. On September 1, 2023, Stone purchased a put option giving it the right to sell 100,000 Australian dollars on March 1, 2024, at a price of $80,000. Stone properly designated the option as a fair value hedge of the Australian dollar firm commitment. The option’s time value is excluded in assessing hedge effectiveness, and the change in time value is recognized in net income over the life of the option. The option cost $2,000 and had a fair value of $2,300 on December 31, 2023. The fair value of the firm commitment was measured by referring to changes in the spot rate (discounting to present value is ignored). The following spot exchange rates apply:

Prepare all journal entries for Stone Company related to this transaction and hedge, and answer the following questions:a. What is the net impact on Stone Company’s 2023 income as a result of this fair value hedge of a firm commitment?b. What is the net impact on Stone Company’s 2024 income as a result of this fair value hedge of a firm commitment and export sale?c. What is Stone Company’s net increase or decrease in cash flow from having purchased the foreign currency option to hedge this exposure to foreign exchange risk?

Step by Step Answer:

Fundamentals Of Advanced Accounting

ISBN: 9781266268533

9th International Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik