Paramount Corporation acquired its 75 percent investment in Sun Corporation in January 2012, for ($2,910,000,) and accounts

Question:

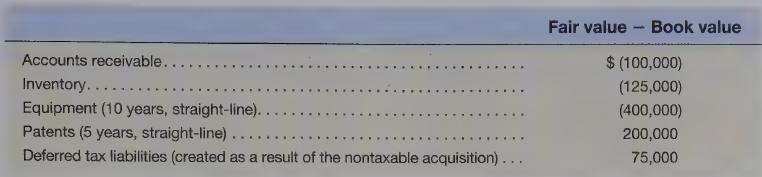

Paramount Corporation acquired its 75 percent investment in Sun Corporation in January 2012, for \($2,910,000,\) and accounts for its investment internally using the complete equity method. At the acquisition date, total book value of Sun was \($1,500,000,\) including \($800,000\) of retained earnings, and the estimated fair value of the 25 percent non- controlling interest was \($790,000.\) The fair values of Sun's assets and liabilities were equal to their carrying values, except for the following items:

The receivables were collected and the inventory sold during the first three years following the acquisition.

Deferred tax liabilities of \($60,000\) were reversed during 2012-2017. An impairment test made at the end of 2017 indicates a remaining value of \($2,000,000\) for the goodwill recognized as a result of the acquisition. Sun’s stockholders’ equity is \($2,500,000,\) including \($1,800,000\) of retained earnings, at the end of 2017.

Required

a. Calculate the amount of goodwill initially recognized as a result of the acquisition, and its allocation to the controlling and noncontrolling interests.

b. Calculate the balance in the investment account, carried on Paramount’s books, and the value of the noncontrolling interest, reported in the equity section of the consolidated balance sheet, as of the end of 2017.

c. Assume eliminating entry (C), to reverse Paramount’s equity method entries for 2018, has been made. Prepare 2018 eliminating entries (E) and (R) to adjust Sun’s assets to the correct values as of the beginning of 2018, eliminate the remainder of the investment, and recognize the beginning-of-2018 value of the noncontrolling interest.

Step by Step Answer: