Pierce Company acquired a 90% interest in Sanders Company on January 1, 2019, for $1,480,000. At this

Question:

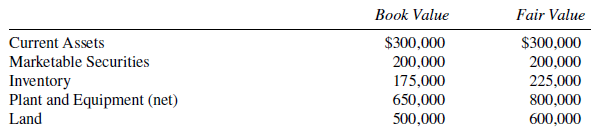

Pierce Company acquired a 90% interest in Sanders Company on January 1, 2019, for $1,480,000. At this time, Sanders Company?s common stock and retained earnings balances were $1,000,000 and $500,000, respectively. An examination of the books of Sanders on the date of purchase revealed the following:

Sanders Company?s equipment has a remaining life of 10 years. Eighty percent of the inventory was sold in 2019, the remainder in 2020.

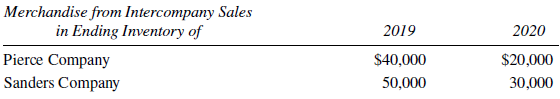

During 2019, Pierce Company sold merchandise costing $400,000 to Sanders at a 25% markup on cost, and Sanders sold merchandise to Pierce Company for $100,000 (this price included $25,000 in profit). In 2020, Pierce Company sold merchandise to Sanders Company for $350,000, while Sanders Company sold merchandise to Pierce Company for $80,000. The 2019 markup percentages were also used on the 2020 sales.

The selling price of intercompany merchandise remaining in ending inventories for both years is summarized here:

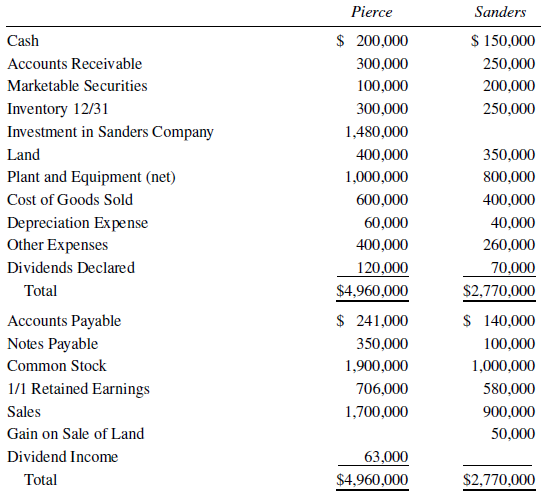

In 2020, Sanders Company also sold a piece of land that had a book value of $250,000 to Pierce Company for $300,000. On December 31, 2020, Pierce Company holds a $60,000 receivable on the merchandise it sold to Sanders Company.

Adjusted trial balances for the year ended December 31, 2020 are shown here:

Required:

Prepare a consolidated statements workpaper for the year ended December 31, 2020.

Common StockCommon stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on...

Step by Step Answer: