Plaza, Inc., acquires 80 percent of the outstanding common stock of Stanford Corporation on January 1, 2024,

Question:

Plaza, Inc., acquires 80 percent of the outstanding common stock of Stanford Corporation on January 1, 2024, in exchange for $900,000 cash. At the acquisition date, Stanford’s total fair value, including the noncontrolling interest, was assessed at $1,125,000. Also at the acquisition date, Stanford’s book value was $690,000.

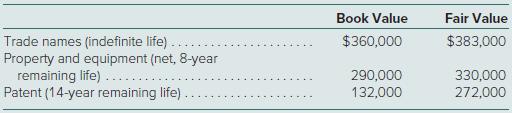

Several individual items on Stanford’s financial records had fair values that differed from their book values as follows:

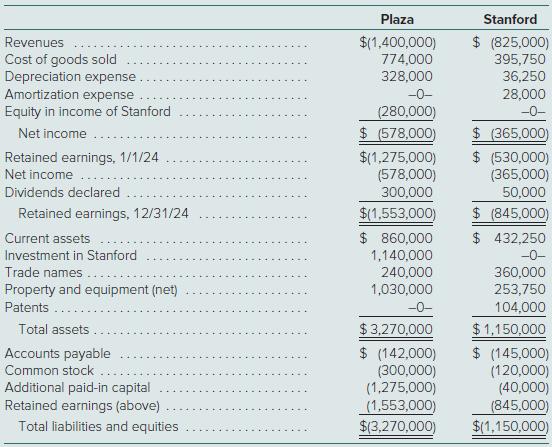

For internal reporting purposes, Plaza, Inc., employs the equity method to account for this investment. The following account balances are for the year ending December 31, 2024, for both companies:

At year-end, there were no intra-entity receivables or payables.Prepare a worksheet to consolidate the financial statements of Plaza, Inc., and its subsidiary Stanford.

Step by Step Answer:

Fundamentals Of Advanced Accounting

ISBN: 9781266268533

9th International Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik