Prance Athleticwear Company owns all of the voting stock of Stallion Shoes. Acquisition cost was ($7) million

Question:

Prance Athleticwear Company owns all of the voting stock of Stallion Shoes. Acquisition cost was \($7\) million in excess of Stallion’s book value of \($3\) million, and the excess was attributed to indefinite lived identifiable intangibles of \($2\) million, and \($5\) million of goodwill. As of the beginning of the current year, the identifiable intangibles are impaired by \($500,000,\) and goodwill is not impaired. There is no impairment of either intangible in the current year. Following is information on intercompany merchandise transactions between Prance and Stallion for the current year:

• Intercompany profit in Prance’s beginning inventory, purchased from Stallion, is \($300,000.\)

• Intercompany profit in Stallion’s beginning inventory, purchased from Prance, is \($400,000.\)

• Intercompany profit in Prance’s ending inventory, purchased from Stallion, is \($200,000.\)

• Intercompany profit in Stallion’s ending inventory, purchased from Prance, is \($250,000.\)

• Total sales from Stallion to Prance, at the price charged to Prance, were \($7\) million.

• Total sales from Prance to Stallion, at the price charged to Stallion, were \($5\) million.

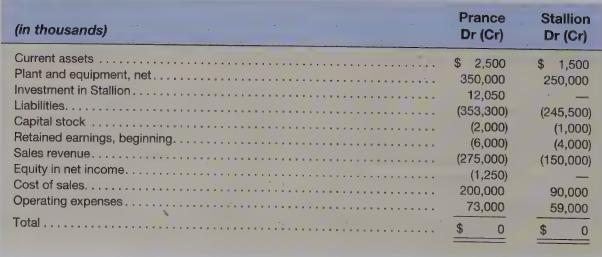

Prance uses the complete equity method to account for its investment in Stallion on its own books. The separate trial balances for Prance and Stallion at the end of the current year are below.

Required

Prepare a working paper to consolidate the trial balances of Prance and Stallion. Label your eliminating entries (C), (I), (E), and (R).

Step by Step Answer: