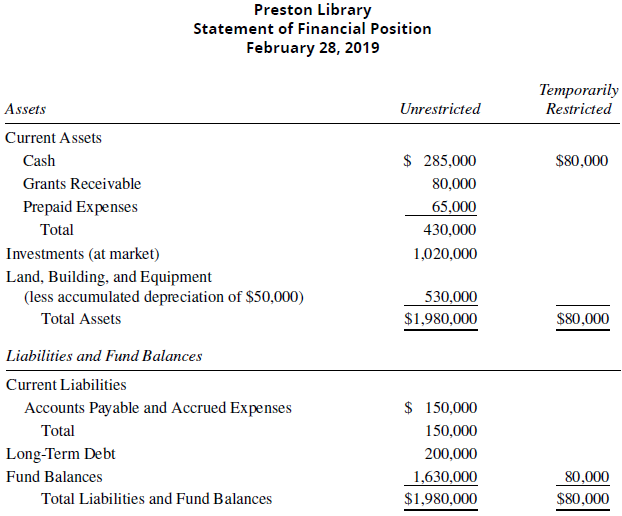

Preston Library, a nonprofit organization, presented the following statement of financial position and statement of activities for

Question:

Preston Library, a nonprofit organization, presented the following statement of financial position and statement of activities for its fiscal year ended February 28, 2019.

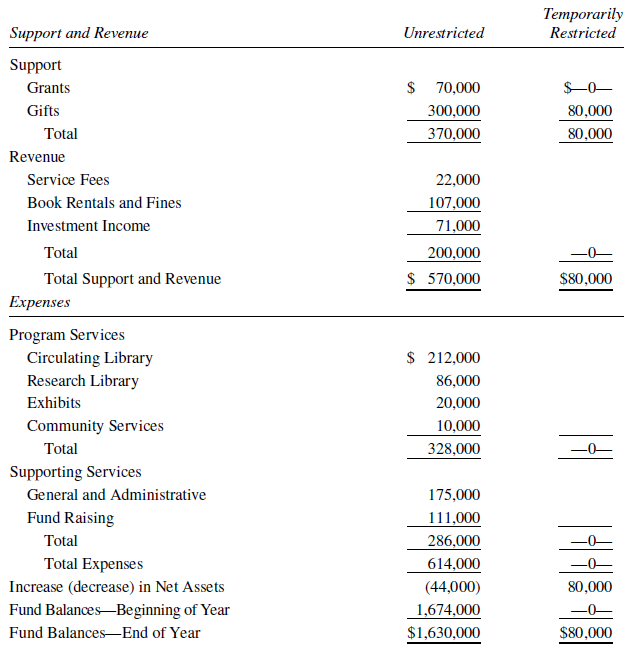

Preston LibraryStatement of Activitiesfor Year Ended February 28, 2019

The following transactions occurred during the fiscal year ended February 28, 2020.

1. Fees were billed as follows:

Service fees ............................ ? ?$30,000

Book rentals ..........................? ? ? ?43,000

Book fines .............................. ? ? ?78,000

2. $40,000 of the Grant Receivable was received. Another grant in the amount of $20,000 was promised.

3. Contributions in the amounts summarized below were received:

Unrestricted .......................... ? ?$215,000

Restricted .............................. ? ? ?108,000

4. Investment income totaled $75,000 for the year.

5. Vouchers for the year were approved as follows:

Circulating library .......................... ? $189,000

Research library ............................ ? ? ? ?74,000

Exhibits ..........................................? ? ? ? 15,000

Community services .....................? ? ? ?12,000

General and administrative ........? ? ?166,000

Fund raising ..................................? ? ?103,000

Total .............................................. ? ?$559,000

6. During the year, $500,000 worth of vouchers were paid.

Adjustment Data

7. Accounts Payable and Accrued Expenses at February 28, 2020, should be $217,000. The difference should be allocated to the following expenses:

Research library .................................................... ? ?$5,000

General and administrative ................................ ? ? ? 3,000

8. Additions to the research library in the amount of $68,000 that were approved in (5) above were made in accordance with the terms of a contribution that had been received earlier and that was restricted for that purpose.

9. The current market value of the investments is $1,035,000 (no investment transactions occurred).

10. Depreciation amounted to $9,000 for the year. It should be allocated as follows:

Circulating library .................................................. ?$3,500

Research library .................................................... ? ?2,900

General and administrative ................................ ? ?2,600

11. Prepaid Expenses should be $60,000. The difference should be allocated to:

Exhibits .................................................................. ?$3,700

General and administrative ................................ ? ?1,300

Required:

A. Prepare journal entries to record the transactions

B. Prepare the statement of financial position and the statement of activities for the year ended February 28, 2020.

Step by Step Answer: