Rance Corporation paid ($10) mil- lion in cash to acquire 30 percent of the voting stock of

Question:

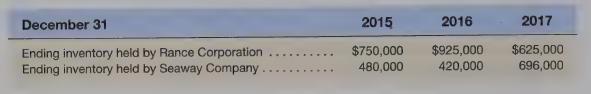

Rance Corporation paid \($10\) mil- lion in cash to acquire 30 percent of the voting stock of Seaway Company on January 2, 2015. Rance uses the equity method to report its investment. Seaway's book value at date of acquisition was \($25\) million. Analysis of Seaway's assets and liabilities reveals that Seaway's property and equipment (10-year life) was overvalued by \($4\) million, and its reported intangibles (2-year life) were undervalued by \($6\) million. During the years 2015 and 2016, Seaway reported total income of \($14\) million, paid dividends of \($5\) million, and reported net unrealized gains on AFS securities of \($1\) million. During 2017, Seaway reported income of \($4\) million, paid dividends of \($1.5\) million, and reported net unrealized losses on AFS securities of \($800,000\). Rance sells merchandise to Seaway at a markup of 20 percent on cost. Seaway sells merchandise to Rance at a markup of 25 percent on cost. Below are the inventories on hand at each balance sheet date, related to these sales.

Required

a. Calculate Rance's equity in net income of Seaway for 2017.

b. Prepare Rance's journal entries to report its investment in Seaway for 2017.

c. Calculate the investment balance, reported on Rance Corporation's balance sheet at December 31, 2017.

Step by Step Answer: