The following summary of transactions was taken from the accounts of the Madras School District General Fund

Question:

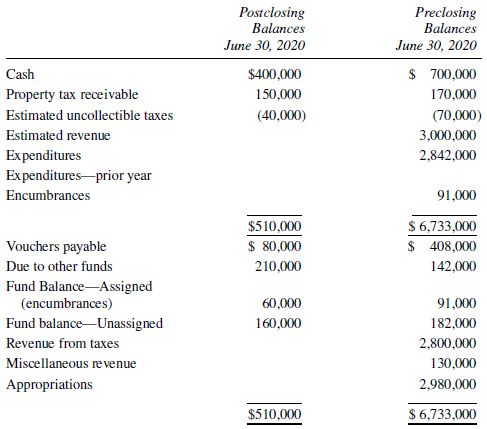

The following summary of transactions was taken from the accounts of the Madras School District General Fund before the books were closed for the fiscal year ended June 30, 2020:

Additional Information:

1. Property taxes in the amount of $2,870,000 were assessed for the year. Taxes collected during the year totaled $2,810,000.

2. An analysis of the transactions in the vouchers payable account for the year ended June 30, 2020, follows:

? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? Debit (Credit)

Current expenditures .................................... ? ?$(2,700,000)

Expenditures for prior year ........................... ? ? ? ? ? (58,000)

Vouchers for payment to other funds ......... ? ? ? ? (210,000)

Cash payments during year .......................... ? ? ? 2,640,000

Net change ..................................................... ? ?$ ? (328,000)

3. During the year the General Fund was billed $142,000 for services performed on its behalf by other city funds.

4. On May 2, 2021, commitment documents were issued for the purchase of new textbooks at a cost of $91,000.

Required:

On the basis of the data presented, reconstruct the original detailed journal entries that were required to record all transactions for the fiscal year ended June 30, 2021, including the recording of the current year?s budget. Do not prepare closing entries at June 30, 2021.

(AICPA adapted)

Step by Step Answer: