The notes to General Mills, Inc.s fiscal 2014 financial statements include the following information on its interest

Question:

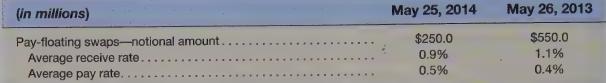

The notes to General Mills, Inc.’s fiscal 2014 financial statements include the following information on its interest rate swaps:

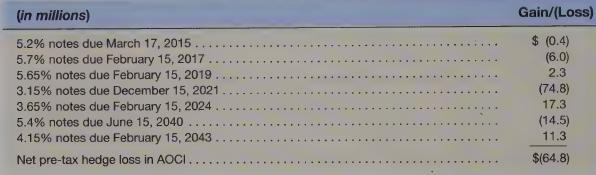

As of May 25, 2014, the pre-tax amount of cash-settled interest rate hedge gain or loss remaining in AOCI which will be reclassified to earnings over the remaining term of the related underlying debt follows:

Required

a. Based on the data in the first table above, explain whether General Mills’ swap position at the end of fiscal 2014 seems more or less beneficial than its position in fiscal 2013. Why do you think General Mills only has “pay-floating” swaps?

b. Look at the second table above. Are the notes payable listed there fixed or floating (variable) rate obligations? How do you know?

c. Inthe second table, the 3.15% notes are reported with a related \($74.8\) million loss, while the 3.65%

notes are reported with a related \($17.3\) million gain. Explain the circumstances leading to a loss on one swap, and a gain on the other. Why does General Mills report a net pre-tax hedge loss of \($64.8\) million on these swaps?

d. What accounts are debited/credited when the swap gains and losses listed in the second table are reclassified to earnings?

Step by Step Answer: