As a senior auditor at CPA LLP, you are beginning your first audit of Burnaby Ltd. for the fiscal year ended December 31, 2021. The

As a senior auditor at CPA LLP, you are beginning your first audit of Burnaby Ltd. for the fiscal year ended December 31, 2021. The engagement team consists of you, the engagement partner, and three junior auditors. Burnaby Ltd. is a retail firm that is publicly listed in the TSX (Toronto Stock Exchange). The company was previously audited by another public accounting firm. During the audit, the following scenarios are encountered. Please respond to the scenario below and summarize your response in a report.

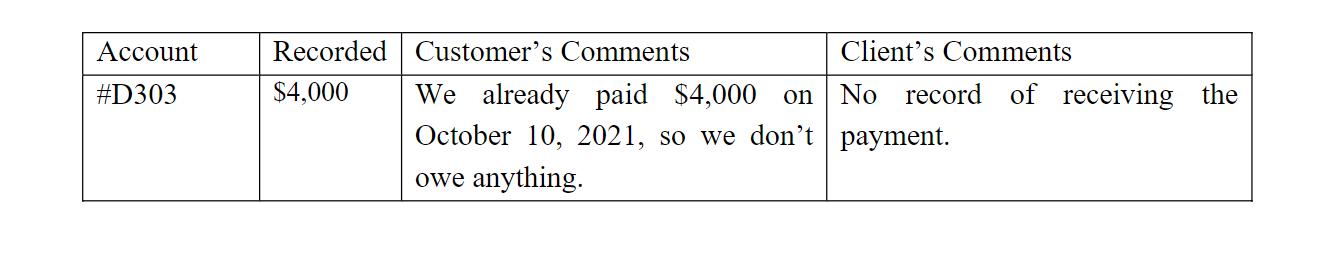

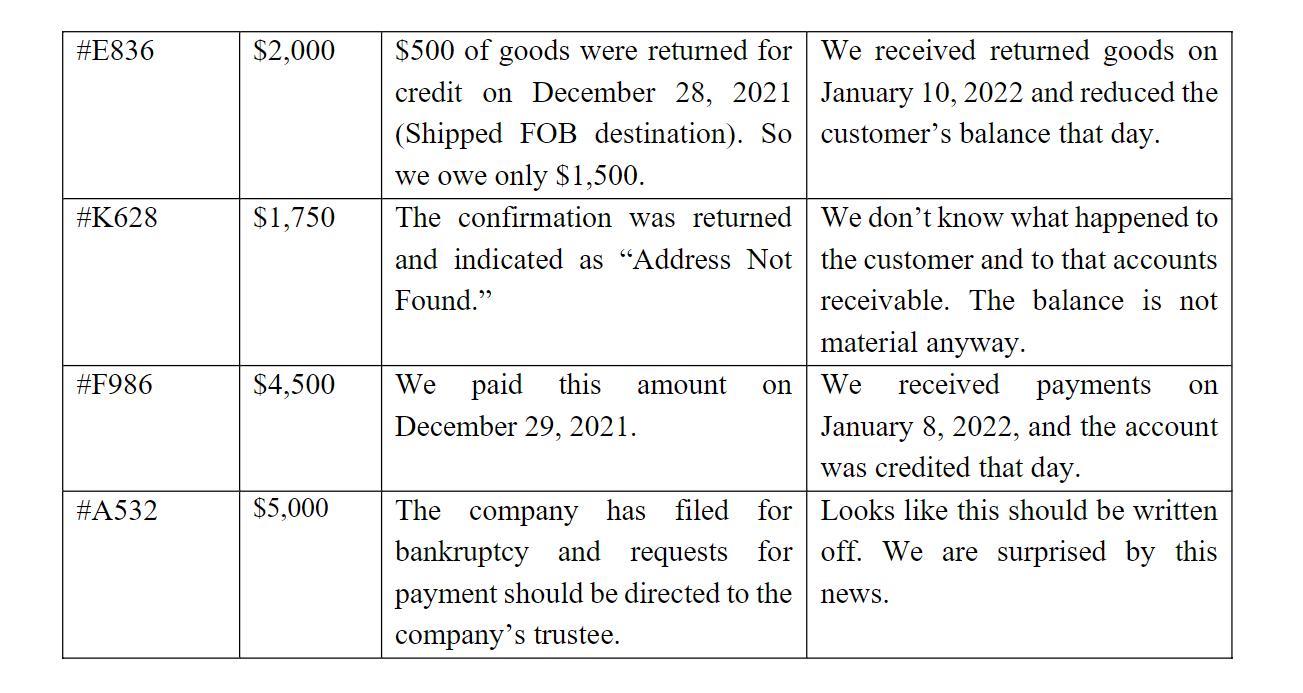

When audit accounts receivable, following your instruction, a junior auditor sent 30 positive

confirmation requests to a random sample of customers as the substantive procedure. The recorded

accounts receivable total $600,000 and include 210 individual customer accounts. Of the 30

confirmations received from the customers, 25 had no exceptions noted, while 5 confirmations

yielded the following results:

Account #D303 Recorded $4,000 Customer's Comments We already paid $4,000 on October 10, 2021, so we don't owe anything. Client's Comments No record of receiving the payment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

In response to the scenario encountered during the audit of Burnaby Ltds accounts receivable the following actions should be taken 1 Assessment of Exceptional Confirmations The confirmations with exce...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started