In February of 2009, Congress passed the American Recovery and Reinvestment Act (ARRA). When this stimulus package

Question:

In February of 2009, Congress passed the American Recovery and Reinvestment Act

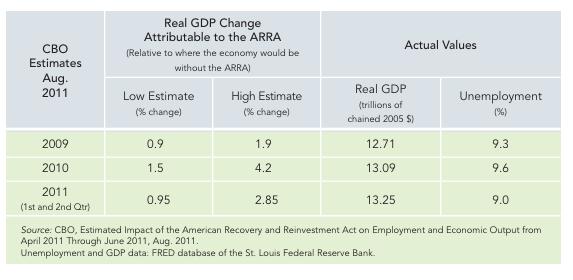

(ARRA). When this stimulus package was signed into law, White House officials projected that it would create, or at least save, 3.5 million jobs, prevent the unemployment rate from rising above 8 percent, and have a multiplier effect on GDP of 1.57 after ten quarters. Prior to the bill’s signing, unemployment was at a 25-year high of 7.8 percent. (It had also reached 7.8 percent during one month in 1992.) In August of 2011, the Congressional Budget Office (CBO)

estimated where the economy was at the end of June that year relative to where it would have been in the absence of the stimulus spending.

Some of its findings are given in the table below. The low and high estimates under Real GDP define the range of how much greater in percentage terms real GDP was because of the stimulus spending than it would have been without it. The CBO also revised its estimate of the stimulus cost at $825 billion instead of the

$787 billion projected at the time of the bill’s signing and estimated that about half the impact occurred during 2010 with about 85 percent of it realized by the end of June 2011.

The 85 percent of the $825 billion stimulus package spent by the end of the second quarter in 2011, amounting to $701.3 billion, was funded through deficit financing and added to the national debt. For comparison to the real GDP figures, $701.3 billion when adjusted for inflation becomes $677.6 billion.

a. For each year, use the real GDP figures in the table below and the low and high percentage estimates of the effect of the stimulus to calculate low and high estimates for the dollar effect of the stimulus.

b. Determine the midpoint of that range for each year and calculate a rough estimate of the total amount of real GDP generated by the stimulus spending for the ten quarters given in the table.

c. Compare the amount you calculated in part b to the inflation adjusted stimulus expenditures of $677.6 billion for the same period and determine if those expenditures appear to have had a multiplier effect, no effect, or generated some crowding out.

d. How do your findings vary if you use the lower or the upper ends of the range of increased real GDP estimated by the CBO?

If multipliers were this simple to generate, which they are not, what do these estimates suggest their sizes might be?

e. Use the chapter material describing the limits to fiscal policy to explain why the size of the impact you found in part c varied from the 1.57 multiplier effect forecasted by the White House at the time of the ARRA legislation

f. Does the American Recovery and Reinvestment Act of 2009 qualify as one of the times when fiscal policy was a good idea? Defend your answer using economic support from the chapter. mk6

Step by Step Answer: