Lets get some practice with the wedge trick, and use it to learn about the relationship between

Question:

Let’s get some practice with the “wedge trick,”

and use it to learn about the relationship between subsidies and lobbying. The U.S.

government has many subsidies for alternative energy development: Some are just called subsidies, some are called tax breaks instead.

Either way, they work just like the subsidies we studied in this chapter. We’ll look at the market for windmills

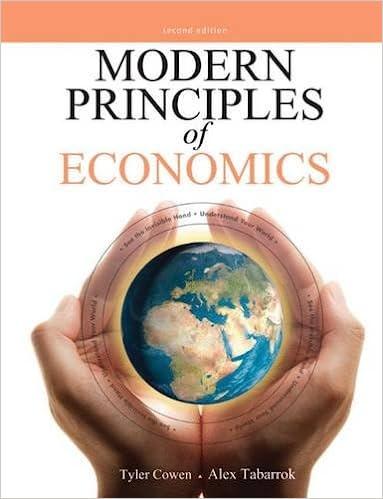

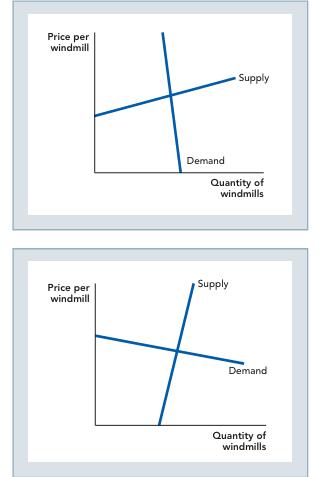

a. In the two figures below, one is a case where the sellers of windmills have an elastic supply and the buyers of windmills (local power companies) have inelastic demand. In the other case, the reverse is true. Which is which? pki5

b. In which case will a subsidy cut the price paid by the buyers the most: When demand is elastic or when it is inelastic? (It’ll be easiest if you use the “wedge trick.”) Is this the first or second graph?

c. In which case will a subsidy increase the price received by the sellers the most:

When supply is elastic or when it is inelastic?

Again, which graph is this?

d. Now look at how producer surplus and consumer surplus change in these two cases.

To see this, remember that producer surplus is the area above the supply curve and below the price, and consumer surplus is the area below the demand curve and above the price.

So in the first graph, who gets the lion’s share of any subsidy-driven extra surplus:

suppliers or demanders? Is that the inelastic group or the elastic group? In other words, whose surplus triangle gets bigger faster as the quantity increases? (You might try shading in these triangles just to be sure.)

e. Now it’s time for the second graph. Again, who gets the lion’s share of any subsidydriven extra surplus: suppliers or demanders?

Is that the inelastic group or the elastic group?

f. There’s going to be a pattern here in parts d and e: The more [elastic or inelastic?] side of the market gets most of the extra surplus from the subsidy.

g. When Congress gives subsidies for the alternative energy market, it is hoping that a small subsidy can get a big increase in output: In other words, they are hoping that the equilibrium quantity will be elastic.

At the same time, the groups most likely to lobby Congress for a big alternative energy subsidy are going to be the groups that get the most extra surplus from any subsidy.

After all, if the subsidy doesn’t give them much surplus, they’re not likely to ask Congress for it.

So here’s the big question: Will the groups that are most likely to lobby for a subsidy be the same groups that are most likely to respond to the subsidy? (Note: This is a general lesson about the incentives for lobbying: It’s not just a story about the alternative energy industry.) pg58

Step by Step Answer: