Milton Friedman famously said that changes in money growth affect the economy with long and variable lags.

Question:

Milton Friedman famously said that changes in money growth affect the economy with

“long and variable lags.” That means that if the government increases growth in the monetary base this month, the money multiplier takes a few months to turn this into growth in checking and savings deposits, and it takes a few months more before businesses and consumers actually spend this money to purchase goods and services. Let’s see how this changes our views of the previous question.

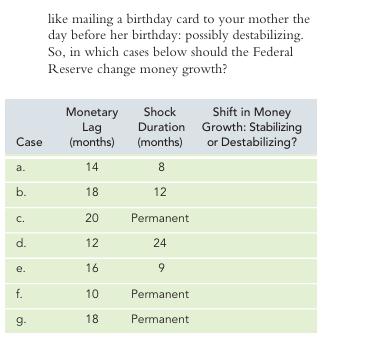

In each case from the previous question, the Fed predicts how long the velocity shock itself will last: We call this “shock duration” in the table below. After that time, velocity growth will go back to its old level. Additionally, in each case, the Fed’s staff of PhD economists estimates how many months it will take for a change in money supply to actually push AD in the desired direction: This is the

“monetary lag.” pg65 The question is quite simple: If monetary lags are shorter than the shock duration—if the Fed has “fair warning”—then a shift in AD will be stabilizing. If not, then a shift in AD will be

Step by Step Answer: