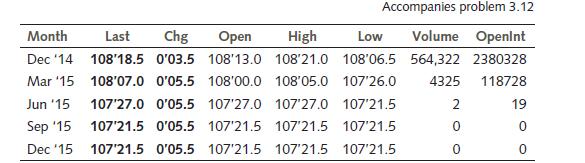

Consider the listing below for 10-year Treasury note futures on the Chicago Board of Trade. One futures

Question:

Consider the listing below for 10-year Treasury note futures on the Chicago Board of Trade. One futures contract for Treasury notes = $100,000 face value of 10-year 6% notes.

a. If today you bought two contracts expiring in December 2014, how much would you pay?

b. What does the “OpenInt” on a futures contract mean? What is the OpenInt on the contract expiring in March 2015?

c. If you were a speculator who expected interest rates to fall, would you buy or sell these futures contracts? Briefly explain.

d. Suppose you sell the December futures contract, and one day later, the Chicago Board of Trade informs you that it has credited funds to your margin account. What happened to interest rates during that day?

Briefly explain.

Step by Step Answer:

Money Banking And The Financial System International Edition

ISBN: 978-1292000183

2nd Edition

Authors: R. Glenn Hubbard ,Anthony P Obrien