Alcantage Ltd owns a chain of dry-cleaning shops in South Wales. A UK-wide dry-cleaning business is considering

Question:

Alcantage Ltd owns a chain of dry-cleaning shops in South Wales. A UK-wide dry-cleaning business is considering making an offer to the shareholders of Alcantage Ltd with the idea of obtaining all the ordinary shares.

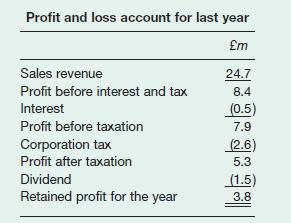

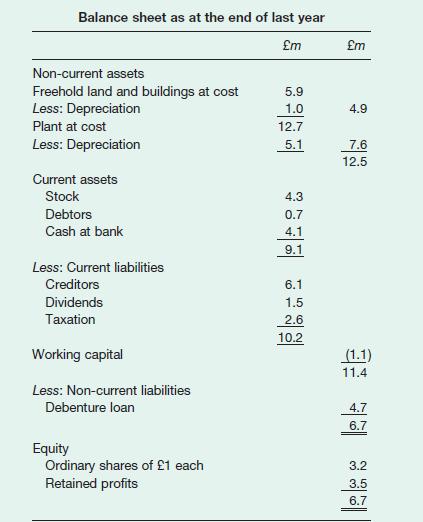

The draft accounts of Alcantage Ltd, for the year that has just ended, can be summarised as follows:

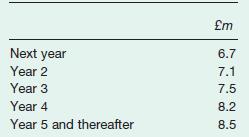

Analysts estimate that the net cash flows of Alcantage Ltd, after taking account of tax and the need to replace non-current and current assets, will be:

The cost of equity of businesses in the industry, taking account of the level of capital gearing, is 12 per cent.

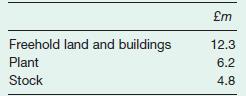

Professional valuers have recently assessed some of Alcantage Ltd’s assets to have market values as follows:

The average of listed businesses in the industry for dividend yield is 7 per cent and for the price/earnings ratio it is 14. The effective basic rate of income tax is 10 per cent.

(a) Estimate the value of a share in Alcantage Ltd on the basis of as many methods as you can from the information provided.

(b) If you were a shareholder in Alcantage Ltd, how, in general terms, would you assess whatever offer you may receive from the national business?

Step by Step Answer: