Bodo Schlegelamich is a currency speculator for a private banking house in Boston. His base currency is

Question:

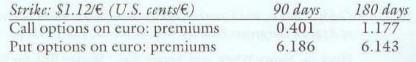

Bodo Schlegelamich is a currency speculator for a private banking house in Boston. His base currency is therefore the U.S. dollar. He is currently convinced that the euro is overvalued and wishes to take a speculative position to profit from his expectations. He will invest \(\$ 1\) million in his position (spent entirely on option premiums). The current spot rate is \(\$ 1.0650 / €\). The current premiums on call and put options (U.S. cents/€) with a strike price of \$1.1200/€ are the following:

a. What should Bodo do-buy a call, sell a call, buy a put, or sell a put on the euro?

b. What would be his profits or losses if he bought a 90 -day call at \(\$ 1.02 / €\), and the actual spot exchange rate in 90 days turned out to be \(\$ 1.08 / €\) ?

Step by Step Answer:

Multinational Business Finance

ISBN: 9780201635386

9th Edition

Authors: David K. Eiteman, Michael H. Moffett, Arthur I. Stonehill, Denise Clinton