Branded Co. (Italy). Branded Co. (Italy) is considering investing Venezuelan bolivar VEF 20,000,000 in Venezuela to build

Question:

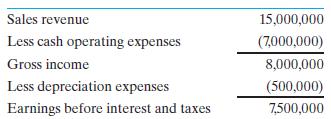

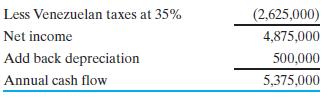

Branded Co. (Italy). Branded Co. (Italy) is considering investing Venezuelan bolivar VEF 20,000,000 in Venezuela to build a wholly owned haute couture plant to export globally. After five years, the subsidiary, BrandVen, would be sold to Venezuelan investors for VEF 40,000,000. A pro forma income statement for the Venezuelan operation predicts the generation of VEF 5,375,000 of annual cash flow, and is listed below

The initial investment will be made on December 31, 2014, and cash flows will occur on December 31 of each succeeding year. Annual cash dividends to BrandVen from Venezuela will equal 75% of accounting income.

The Italian corporate tax rate is 20% and the Venezuelan corporate tax rate is 35%. Since the Venezuelan tax rate is greater than the Italian tax rate, annual dividends paid to Branded Co. will not be subject to additional taxes in Italy. There are no capital gains taxes on the final sale. Branded Co. uses a weighted average cost of capital of 18% on domestic investments, but will add 8 percentage points for the Venezuelan investment because of perceived greater risk. Branded Co. forecasts the Venezuelan bolivar/

euro exchange rate for December 31 for the next six years as listed below.

What is the net present value and internal rate of return on this investment?

Step by Step Answer:

Multinational Business Finance

ISBN: 9781292097879

14th Global Edition

Authors: David Eiteman, Arthur Stonehill, Michael Moffett