Fortunate plcs capital structure (taken from the balance sheet) is as follows: The business pays corporation tax

Question:

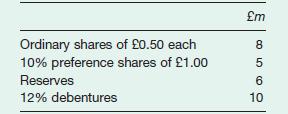

Fortunate plc’s capital structure (taken from the balance sheet) is as follows:

The business pays corporation tax at the rate of 50 per cent and is expected to earn a consistent annual profit, before interest and tax, of £9m.

The current market prices of the business’s shares are:

Preference shares £0.65 Ordinary shares £0.80 The debentures are irredeemable and have a market value of £100 per £100 nominal value.

What is the weighted average cost of capital, assuming that shareholders regard retained profit and dividends as equally valuable?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: