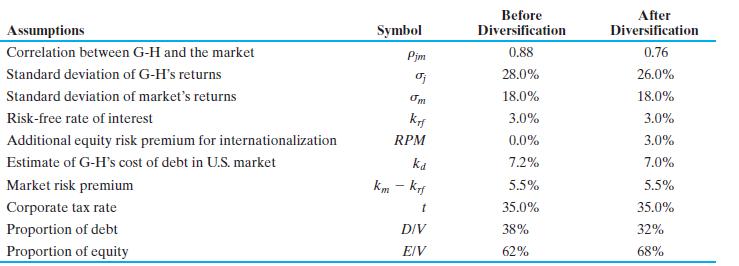

Genedak-Hogan Cost of Equity. Senior management at Genedak-Hogan are actively debating the implications of diversification on its

Question:

Genedak-Hogan Cost of Equity. Senior management at Genedak-Hogan are actively debating the implications of diversification on its cost of equity. All agree that the company’s returns will be less correlated with the reference market return in the future, the financial advisors believe that the market will assess an additional 3.0% risk premium for “going international” to the basic CAPM cost of equity. Calculate Genedak-

Hogan’s cost of equity before and after international diversification of its operations, with and without the hypothetical additional risk premium, and comment on the discussion.

Use the table below to answer this problem. Genedak-Hogan is an American conglomerate that is actively debating the impacts of international diversification of its operations on its capital structure and cost of capital. The firm is planning on reducing consolidated debt after diversification.

Step by Step Answer:

Multinational Business Finance

ISBN: 9781292097879

14th Global Edition

Authors: David Eiteman, Arthur Stonehill, Michael Moffett