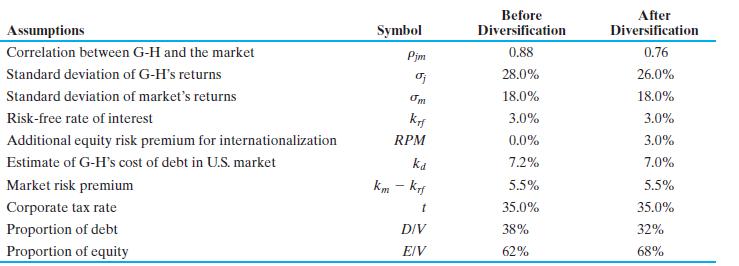

Genedak-Hogans WACC. Calculate the weighted average cost of capital for Genedak-Hogan before and after international diversification. a.

Question:

Genedak-Hogan’s WACC. Calculate the weighted average cost of capital for Genedak-Hogan before and after international diversification.

a. Did the reduction in debt costs reduce the firm’s weighted average cost of capital? How would you describe the impact of international diversification on its costs of capital?

b. Adding the hypothetical risk premium to the cost of equity introduced in Problem 10 (an added 3.0%

to the cost of equity because of international diversification), what is the firm’s WACC?

Use the table below to answer this problem. Genedak-Hogan is an American conglomerate that is actively debating the impacts of international diversification of its operations on its capital structure and cost of capital. The firm is planning on reducing consolidated debt after diversification.

Step by Step Answer:

Multinational Business Finance

ISBN: 9781292097879

14th Global Edition

Authors: David Eiteman, Arthur Stonehill, Michael Moffett