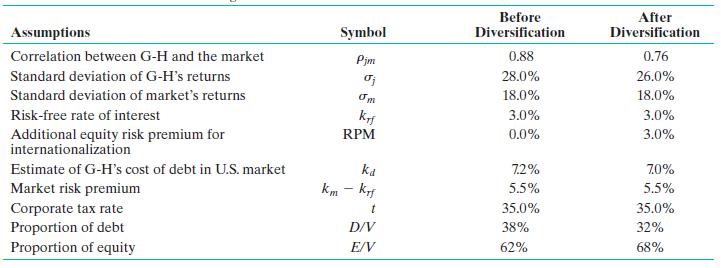

Genedak-Hogans WACC. Calculate the weighted average cost of capital for Genedak-Hogan before and after international diversification. a.

Question:

Genedak-Hogan’s WACC. Calculate the weighted average cost of capital for Genedak-Hogan before and after international diversification.

a. Did the reduction in debt costs reduce the firm’s weighted average cost of capital? How would you describe the impact of international diversification on its costs of capital?

b. Adding the hypothetical risk premium to the cost of equity introduced in Problem 13.8 (an added 3.0% to the cost of equity because of international diversification), what is the firm’s WACC?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Multinational Business Finance

ISBN: 9781292270081

15th Global Edition

Authors: David Eiteman, Arthur Stonehill, Michael Moffett

Question Posted: