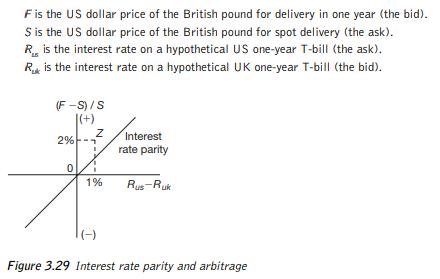

Interest rate parity Consider Figure 3.29, which indicates (approximately) the difference between interest rates in the United

Question:

Interest rate parity Consider Figure 3.29, which indicates (approximately) the difference between interest rates in the United States and the UK, Rus Ruk on a one-year T-bill (i.e. a two-year bill with one year left to maturity) on the horizontal axis, and the forward premium on the pound for delivery in one year, (F – S)/S, on the vertical axis. If you wish, assume you already hold a portfolio of both T-bills. Note:

a. At point Z, in what direction will short-term arbitrage capital flow and what will be the arbitrage profits?

b. What steps will arbitrageurs take from point Z in order to make their profits and what will be the consequences on the forward discount on the pound and the interest rate differential?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: