La Mer plc has one asset, a luxury yacht, which is chartered to parties of rich holidaymakers.

Question:

La Mer plc has one asset, a luxury yacht, which is chartered to parties of rich holidaymakers.

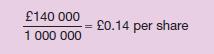

Profits of the business over the next few years are expected to be £140 000 p.a. La Mer is financed entirely by equity, namely 1m ordinary shares whose current market value is

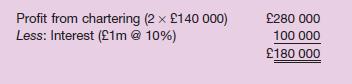

£1 each. The business pays all of each year’s profit to shareholders as a dividend. La Mer plc intends to buy an additional, similar vessel, also expected to generate annual profits of £140 000 p.a., at a cost of £1m. The finance for this is to be provided by the issue of £1m of 10 per cent loan stock. The loan is to be secured on the two vessels.

Without the new yacht, the return per share is expected to be:

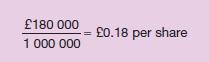

If the second yacht is acquired, the annual return per share will be:

that is:

Thus the expected return is increased by the use of loan stock. (Note that if the finance for the new yacht had been raised by issuing 1m ordinary shares of £1 each, the annual return per share, with the second yacht, would have remained at £0.14.)

Step by Step Answer: