Opus Soft Drinks Ltd (Opus), an unlisted business, produces a range of mineral waters, mixers and fruit

Question:

Opus Soft Drinks Ltd (‘Opus’), an unlisted business, produces a range of mineral waters, mixers and fruit juices. Opus was formed in the 1980s by a consortium of listed brewery businesses to supply soft drinks for sale in their tied public houses and hotels. Opus makes about 20 per cent of its sales to customers other than members of the consortium.

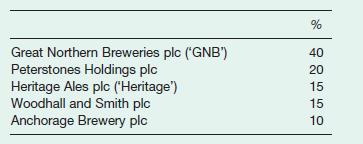

At present Opus’s ordinary shares are owned as follows:

Heritage wishes to sell its shares in Opus, and GNB has agreed to buy all of these, subject to a reasonable price being agreed.

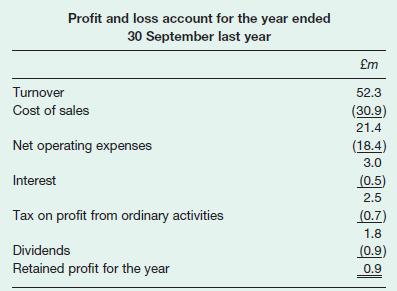

Opus’s latest annual report contained financial statements that can be summarised as follows:

Depreciation of non-current assets for the year totalled £2.4m.

These results are fairly typical of Opus’s performance over recent years, when adjusted for inflation.

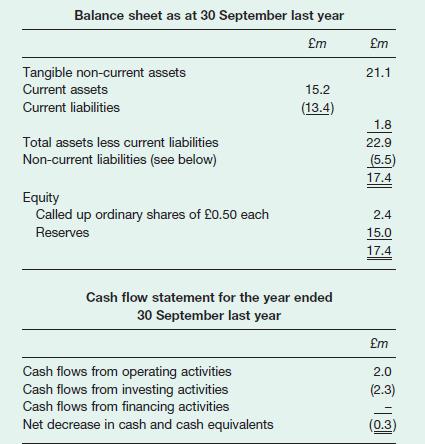

The non-current liabilities consist of a debenture due for redemption in five years’

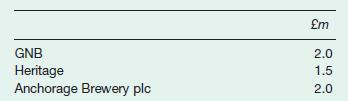

time. This is owned as follows:

The average figures for the Food Producers sector of the FTSE Actuaries Index are:

Price/earnings ratio 18.38 Dividend cover 1.84

(a) Estimate a value per ordinary share in Opus using three methods. Explain your calculations, the logic of each method, and any assumptions that you have needed to make.

(b) Discuss the suitability of each of your estimations, in the context of the particular circumstances, as the basis of the price per share to be agreed between GNB and Heritage.

(c) Explain any factors that you believe will influence the final price to be agreed between GNB and Heritage.

Step by Step Answer: