ScotchOrganic Co. Privately owned ScotchOrganic Co. is considering investing in Romania to cut down on transportation costs

Question:

ScotchOrganic Co. Privately owned ScotchOrganic Co. is considering investing in Romania to cut down on transportation costs to Eastern European markets.

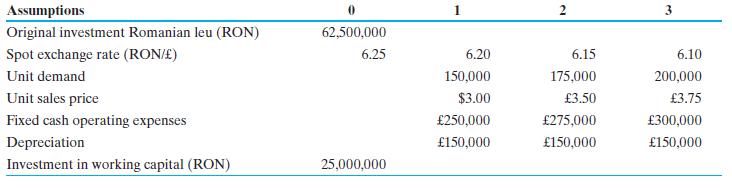

The original investment in Romanian leu (RON)

would amount to RON62,500,000 or £10,000,000 at the current cross rate of RON6.25/£, all in fixed assets, which will be depreciated over 10 years by the straight-line method. An additional RON25,000,000 will be needed for working capital.

For capital budgeting purposes, ScotchOrganic Co. assumes a sale as a going concern at the end of the third year at a price, after all taxes, equal to the net book value of fixed assets alone (not including working capital). All free cash flow will be repatriated to Scotland as soon as possible. In evaluating the venture, the British pound forecasts are shown in the table above.

Variable manufacturing costs are expected to be 75% of sales. No additional funds need be invested in pounds during the period under consideration. Romania imposes no restrictions on repatriation of any funds of any sort. The Romanian corporate tax rate is 20% and the Scottish rate is 25%. Both countries allow a tax credit for taxes paid in other countries.

ScotchOrganic Co. uses 15% as its weighted average cost of capital, and its objective is to maximize present value. Is the investment attractive to Scotch-

Organic Co.?

Step by Step Answer:

Multinational Business Finance

ISBN: 9781292097879

14th Global Edition

Authors: David Eiteman, Arthur Stonehill, Michael Moffett