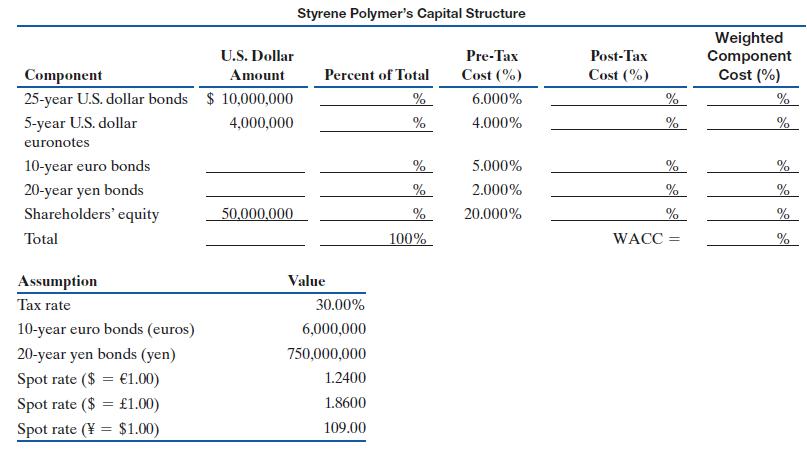

Styrene Polymers, Inc., a U.S. medical plastics manufacturer, has the following debt components in its consolidated capital

Question:

Styrene Polymers, Inc., a U.S. medical plastics manufacturer, has the following debt components in its consolidated capital section.

Styrene’s finance staff estimates their cost of equity to be 20%. Current exchange rates are also listed below.

Income taxes are 30% around the world after allowing for credits. Calculate Styrene’s weighted average cost of capital. Are any assumptions implicit in your calculation?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Multinational Business Finance

ISBN: 9781292445960

16th Global Edition

Authors: David Eiteman, Arthur Stonehill, Michael Moffett

Question Posted: