Tektronix, Inc., an Oregon-based MNE, manufactures scientific instruments. Jerry Davies, Treasurer, needs to choose an instrument to

Question:

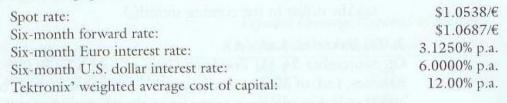

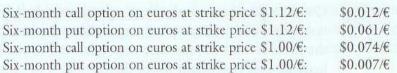

Tektronix, Inc., an Oregon-based MNE, manufactures scientific instruments. Jerry Davies, Treasurer, needs to choose an instrument to hedge a \(€ 2,000,000\) sale to Siemens in Germany, with payment due in six months. He has obtained the following quotes from Citibank.

a. What are the costs of each alternative?

b. Diagram each alternative.

c. What are the risks of each alternative?

d. Which alternative should Jerry Davies choose if he prefers to "play it safe"?

e. Which alternative should he choose if he is willing to take a reasonable risk and he has a directional view that the euro may be appreciating versus the dollar in the coming months?

f. Which alternative should he choose if he is willing to take a reasonable risk and he has a directional view that the euro may be depreciating versus the dollar in the coming months?

g. Identify and calculate the break-even points between alternatives (exclude the \(\$ 1.12 / €\) strike prices). Use the diagram of Dayton's alternatives in the chapter as a guide.

Step by Step Answer:

Multinational Business Finance

ISBN: 9780201635386

9th Edition

Authors: David K. Eiteman, Michael H. Moffett, Arthur I. Stonehill, Denise Clinton