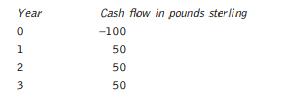

The time value of money Consider the following cash flows from today (year zero) to year 3

Question:

The time value of money Consider the following cash flows from today (year zero) to year 3 in pounds sterling:

Your interest rate (or discount rate) in pounds is 10 percent. a Compute the net present value (NPV) at a 10 percent discount rate and the internal rate of return (IRR) of this investment in pounds. b If you were to sell this investment today (its NPV in pounds), how much would it be worth in USD at 1.76 dollars per pound?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: