To see how the MM assertion would work in the case of La Mer, let us assume

Question:

To see how the MM assertion would work in the case of La Mer, let us assume that the business raised the £1m for the second vessel by issuing a 10 per cent debenture (that is, borrowing at 10 per cent p.a.). Let us also assume that there is another business, Sea plc, identical in every respect to La Mer, but completely financed by 2m ordinary shares of

£1 each.

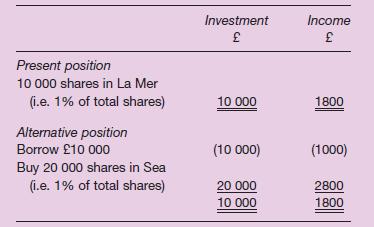

Franco, a holder of 1 per cent of the equity of La Mer (that is, 10 000 shares), would expect a return on them of £1800 p.a. since, as we have seen, each one is expected to yield 18p p.a. Franco could equally well obtain the same expected income by selling the shares for £10 000, borrowing an amount equivalent to 1 per cent of La Mer’s borrowings (that is,

£10 000) at the rate of 10 per cent p.a. and using this total of £20 000 to purchase 1 per cent of the ordinary shares in Sea (20 000 shares). The Sea shares would be expected to yield 14p each and so £2800 in total, which, after paying interest on the borrowing, would leave

£1800 p.a. of expected income of equal risk (business and financial) as that of the expected income from La Mer. Franco’s situation may be restated and summarised as follows:

Step by Step Answer: