Triple-A: Revenue Growth, Sales Price, and Currency Risk Scenario. Leila Smith, a new analyst at Triple-A and

Question:

Triple-A: Revenue Growth, Sales Price, and Currency Risk Scenario. Leila Smith, a new analyst at Triple-A and a recent MBA graduate, believes that it is a fundamental error to evaluate the Israeli project’s prospective earnings and cash flows in pounds, rather than first estimating their Israeli shekel (ILS)

value, and then converting cash flow returns to the United Kingdom in pounds. She believes the correct method is to use the end-of-year spot rate in 2015 of ILS4.80/GBP and assume it will change in relation to purchasing power. (She is assuming U.K.

inflation to be 1% per annum and Israel inflation to be 5% per annum). She also believes that Triple-A should use a risk-adjusted discount rate in Israel that reflects Israel capital costs (20% is her estimate), and a risk-adjusted discount rate for the parent viewpoint capital budget (18%), on the assumption that international projects in a risky currency environment should require a higher expected return than other lower-risk projects. How do these assumptions and changes alter Triple-A’s perspective on the proposed investment?

Triple-A Linen, Inc., U.K., exports 50,000 high-quality duvet sets per year to Israel under an import license that expires in five years. In Israel the duvet sets are sold for the Israeli shekel equivalent of £80 per set. Direct manufacturing costs in the United Kingdom and shipping together amount to £50 per set. The market for this type of duvet in Israel is stable, neither growing nor shrinking, and Bang Linen holds the major portion of the market.

The Israeli government has invited Triple-A Linen to open a manufacturing plant so imported duvets can be replaced by local production. If Triple-A Linen makes the investment, it will operate the plant for five years and then sell the building and equipment to Israeli investors at net book value at the time of sale plus the value of any net working capital. (Net working capital is the amount of current assets minus any portion financed by local debt.) Triple-A will be allowed to repatriate all net income and depreciation funds to the United Kingdom each year. Triple-A Linen traditionally evaluates all foreign investments in British pound (GBP)

terms.

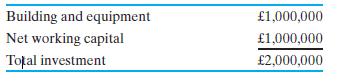

■ Investment. Triple-A’s anticipated cash outlay in pounds in 2015 would be as follows:

All investment outlays will be made in 2018, and all operating cash flows will occur at the end of years 2016 through 2020.

■ Depreciation and Investment Recovery. Building and equipment will be depreciated over five years on a straight-line basis. At the end of the fifth year, the £1,000,000 of net working capital may also be repatriated to the United Kingdom, as may the remaining net book value of the plant.

■ Sales Price of Duvets. Locally manufactured duvets will be sold for the Israeli shekel equivalent of £80 per set.

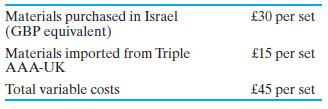

■ Operating Expenses per Set of Duvets. Material purchases are as follows:

■ Transfer Prices. The £10 transfer price per set for raw material sold by the parent consists of £5 of direct and indirect costs incurred in the United Kingdom on their manufacture, creating £5 of pre-tax profit to Triple-AAA.

■ Taxes. The corporate income tax rate is 40% in both Israel and the United Kingdom. There are no capital gains taxes on the future sale of the Israeli subsidiary, either in Israel or the United Kingdom.

■ Discount Rate. Triple-AAA Components uses a 15%

discount rate to evaluate all domestic and foreign projects.

Step by Step Answer:

Multinational Business Finance

ISBN: 9781292097879

14th Global Edition

Authors: David Eiteman, Arthur Stonehill, Michael Moffett