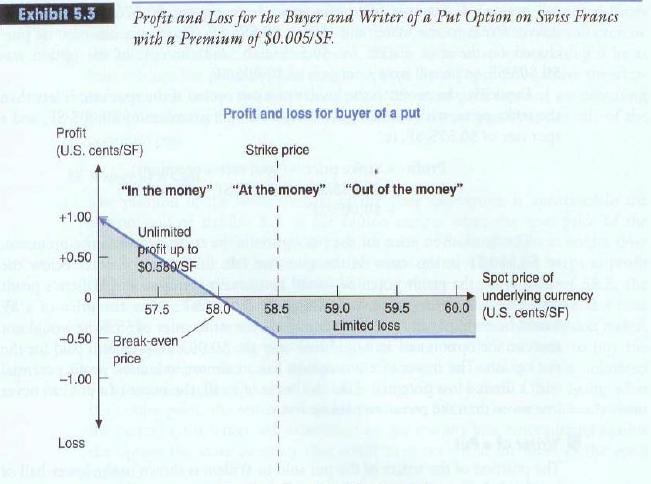

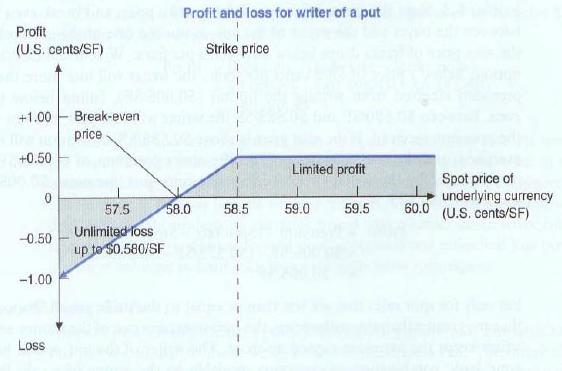

Willem is now writing put options on Swiss francs, puts with strike prices of 58.5 (cents/SF) as

Question:

Willem is now writing put options on Swiss francs, puts with strike prices of 58.5 (cents/SF) as in Exhibit 5.3.

a. What in the world is he thinking? What is his precise directional view?

b. How far does the spot rate have to move in order for Willem to actually break even?

c. How would an increase in option volatility affect the option position he opened by writing the put options? How could he take advantage of the new higher premiums?

d. What is the limit to his profit potential?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Multinational Business Finance

ISBN: 9780201635386

9th Edition

Authors: David K. Eiteman, Michael H. Moffett, Arthur I. Stonehill, Denise Clinton

Question Posted: