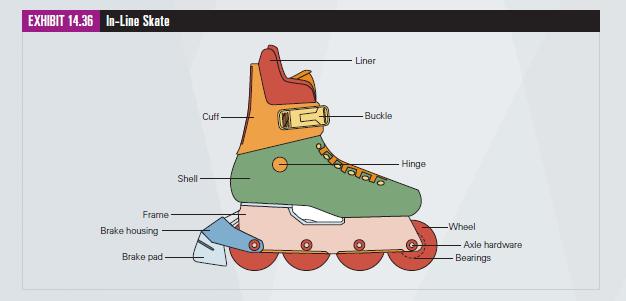

Rocker Industries (RI) produces recreational in-line skates (see Exhibit 14.36). Demand is seasonal, peaking in the summer

Question:

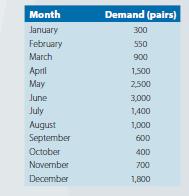

Rocker Industries (RI) produces recreational in-line skates (see Exhibit 14.36). Demand is seasonal, peaking in the summer months, with a smaller peak demand during December. For one of their more popular models that is being introduced with some cosmetic upgrades, RI has forecasted the following demand in pairs of skates for the next year (these data are available in the worksheet Rocker Industries Case Data.xlsx).

The manufacturing cost is \($80\) for each pair of skates, including materials and direct labor. Inventory holding cost is charged at 20 percent of the manufacturing cost per month. Because this is an “on-demand” good, customers will most likely buy another model if it is not available, thus, the lost sales cost is the marginal profit, which is the manufacturer markup of 100 percent or \($80.\) The normal production rate is 1,000 pairs per month. However, changing the production rate requires administrative costs and is computed to be \($1\) per unit. Overtime can be scheduled at a cost computed to be \($10\) per pair. Assume beginning inventories are zero. Because Rocker Industries produces a variety of other products, labor can be shifted to other work, so undertime cost is not relevant.

Case Questions for Discussion

1.Rocker Industries would like to evaluate level and chase demand strategies.

Your report should not only address financial impacts, but also potential operational and managerial impacts of the different strategies.

2.Rocker Industries would like to know the lowest cost aggregate plan. Use the Aggregate Planning Excel template to search for the best solution.

Step by Step Answer:

Operations And Supply Chain Management

ISBN: 9780357901649

3rd Edition

Authors: David A. Collier; James Evans